From Capacity Building to Risk Sharing

Unlocking EU Funds for Social Economy - Blog Series

Public-private partnerships for financial and non-financial support (i.e. capacity building) are essential to build and strengthen the social economy in the EU. The public sector can provide growth capital to social enterprises (e.g. grants) and mobilise private investments through risk-sharing mechanisms (e.g. guarantee schemes to repayable finance) that otherwise would not be met by the market alone. That is why the new EU Social Economy Action Plan plans to increase EU support for the various stages of social enterprises’ life-cycle (i.e. seed, start-up, scaling), with the InvestEU and the ESF+ funding programmes – the most relevant to support the investing for impact sector.

How can social investors make use of EU funds to better support social enterprise and the social economy? Find inspiration from how the German Financing Agency for Social Entrepreneurship (FASE) succeeded in doing this, in the first of a series of case studies aiming to raise awareness of EU co-funding opportunities. Understanding the allocation of previous EU funds can help social investors tap into new opportunities to access financial instruments falling within the InvestEU, in particular within the Social Investment & Skills window.

Surviving the “Valley of Death”

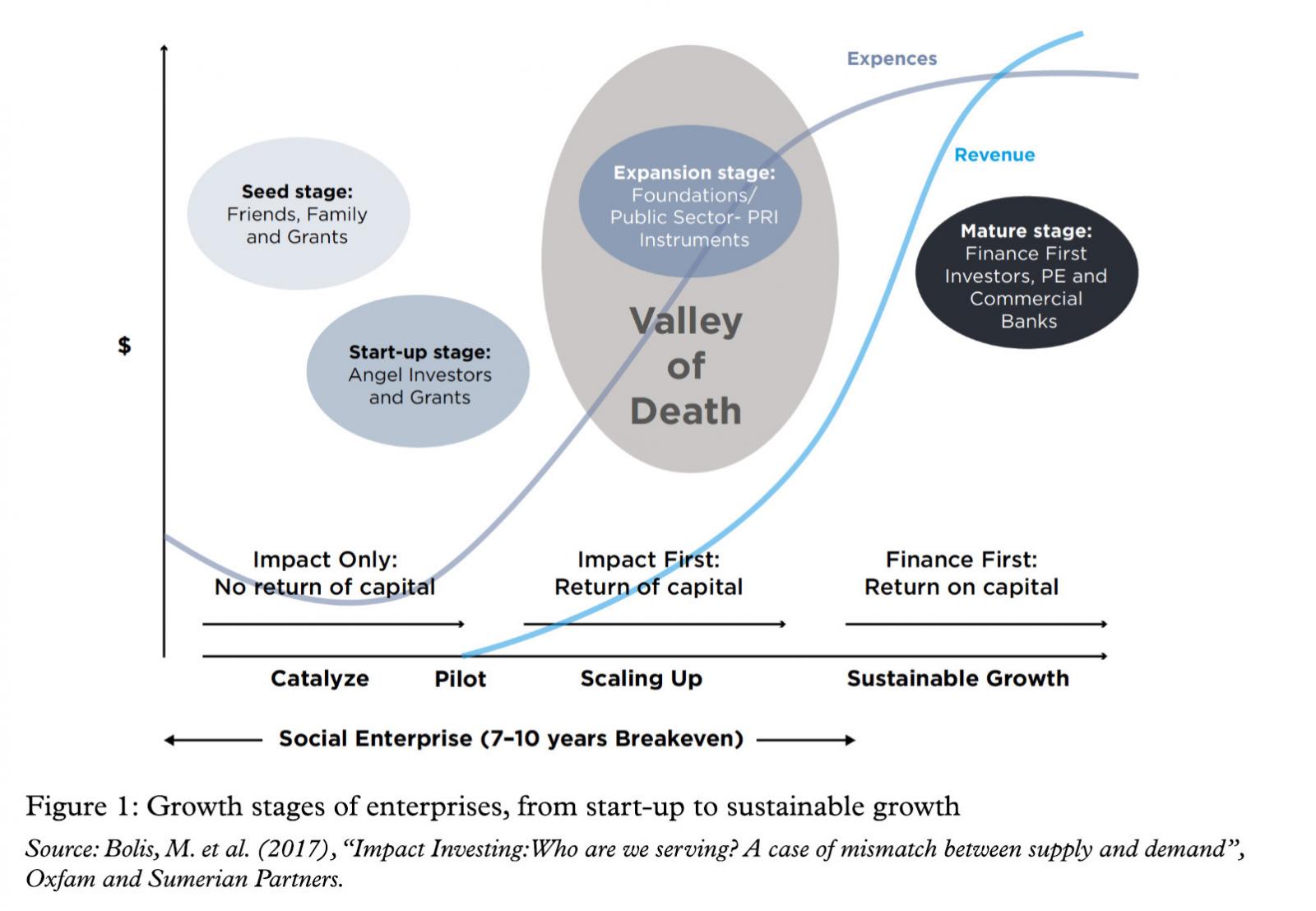

The EU Social Economy Action Plan recognises the potential of the social economy to create quality jobs and contribute to fair, sustainable and inclusive growth. However, early-stage social enterprises still face many barriers to accessing growth capital. This stage is often referred to as the ‘Valley of Death’: social enterprises in this stage require investments that are too large and commercial for donations or philanthropic foundations, but too small and risky for traditional investors. Moreover, the cost of small ticket size transactions is disproportionally high for investors compared to the size and limited financial upside. Investors therefore tend to wait to scale more mature social enterprises requiring larger ticket sizes. This risks drying out the investment pipeline due to the lack of financial support for social enterprises early on.

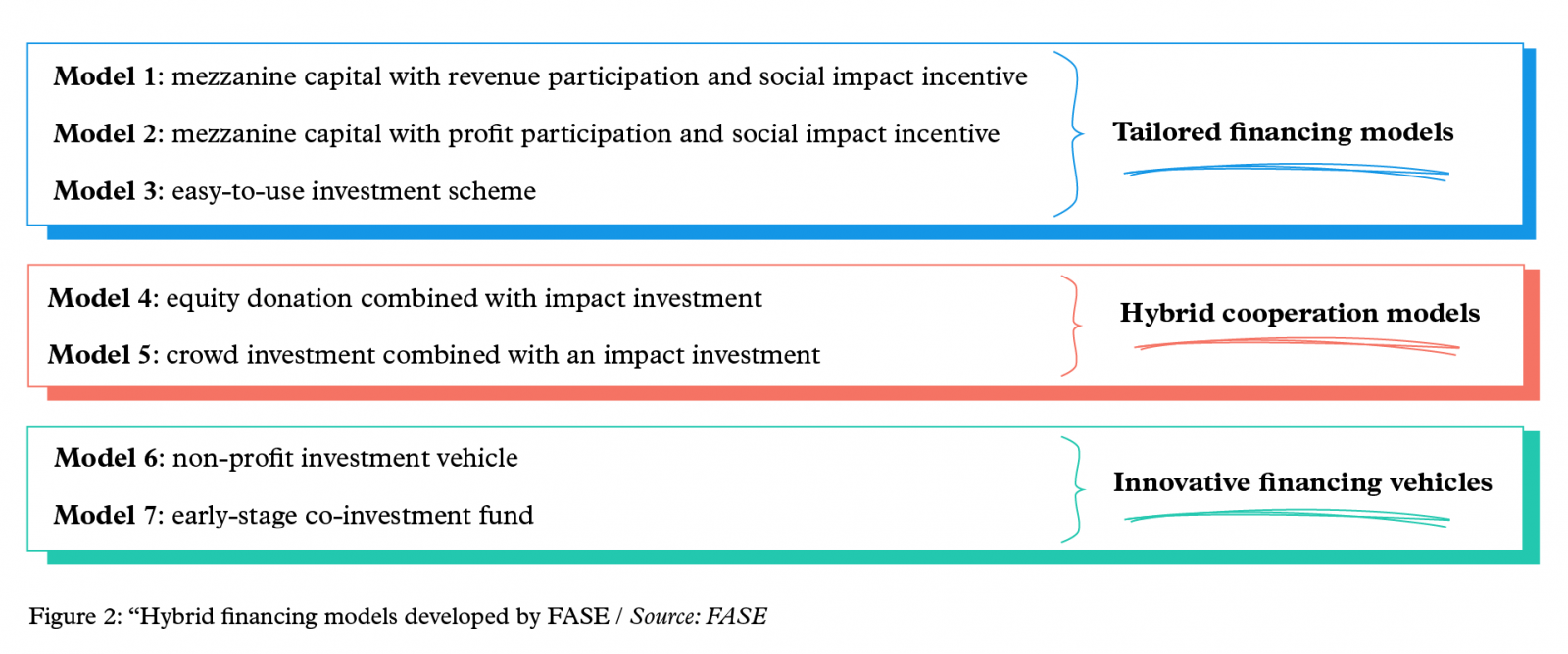

Fortunately, financial intermediaries such as the Financing Agency for Social Entrepreneurship (FASE) in Germany are dedicated to building bridges between different social investors and early-stage social enterprises to drive social innovation. FASE provides hybrid funding to early-stage social enterprises through tailored “deal-by-deal” support, designing innovative financing schemes - i.e. equity, mezzanine, hybrid or debt - that match the needs of social enterprises and impact investors. It also supports both sides during the whole transaction process, helps social enterprises become investment-ready, and secures impact-minded investors by building awareness on the impact, risks and return prospects of social impact investments.

FASE’s EU success story

FASE was able to successfully build the social finance market with innovative financing models in different European regions as part of the European Programme for Employment and Social Innovation (EaSI) between 2014 and 2020. EaSI is an EU level financing instrument managed by the European Commission. The goal is to promote quality and sustainable employment, decent social protection and working conditions, combat social exclusion and poverty in the EU. The program recognises the need to develop the social finance market and to improve access to finance for social enterprises to achieve these key objectives. FASE benefited from the EaSI transaction cost support to social enterprise finance that aims at catalysing smaller risk-capital investments (< €500,000) to social enterprises that otherwise would not happen.

Building Bridges

In the first stage of the project (2014-2018), FASE was able to develop and test its innovative financing models of blending different financial instruments and tailored support to match the needs of social enterprises and investors. This is particularly interesting for hybrid social enterprises with both non-profit and for-profit subsidiaries. The former can receive donations and public grants, while for the latter, the most appropriate financing instrument is typically quasi-equity, such as Mezzanine capital. Moreover, FASE’s hybrid cooperation models combine different types of financing (from impact investors to philanthropic capital providers) in a single deal. Thanks to the EaSI fund, FASE developed a transaction cost support to mobilise risk capital investments below €500,000, which are typically needed by early-stage social enterprises. Since the EaSI guarantee provide only partial credit risk protection, financial intermediaries are allowed to combine EaSI guarantee with other financial instruments or credit risk protection, as in the case of FASE. Such possibility made the transactional cost support even more attractive to investors to support early-stage social enterprises, and successfully test and scale the solution in two pilot regions, Benelux and Austria.

Scaling innovative solutions

In the second phase of the project (2018-2020), the EaSI support enabled FASE to scale up its business model to develop a pan-European Social Finance market and launch the European Social Innovation and Impact Fund (ESIIF). The project focused on expanding the transaction cost support to smaller risk-capital investments in its core markets (Germany, Austria and Benelux) to new investors and social enterprises in other European regions (France, Spain, Italy, CEE, and Scandinavia). In this way, FASE was able to support more than 50 social enterprises, build a network of more than 1,000 funders and channel €25 million to the social economy around Europe. With the EU support to conceptualise the ESIIF, FASE was also able to build a more sustainable business model. This new source of income allowed it to be less dependent on project-based revenue.

Risk-sharing for social impact

What is unique about the European Social Innovation and Impact Fund (ESIIF)?

- The first impact mezzanine fund to have received the EaSI Guarantee.

- Focused on social enterprises with a measurable contribution to solving social and/or environmental problems.

- Diversified target portfolio of around 60 early-stage social enterprises.

- Investors can choose two different risk-return profiles, junior and senior tranches.

- Fund investors and direct investors invest alongside.

- Low management fees due to passive investment approach.

- Term of 10 years plus twice and extension option by one year each.

The European Social Innovation and Impact Fund (ESIIF) mobilises additional risk capital to help bridge the funding gap for early-stage social enterprises and scale their impact. ESIIF is designed as a closed-end fund that provides mezzanine capital – a hybrid of debt and equity financing– to 60 selected early-stage social enterprises located in the European Union, focused on a wide range of areas such as education, health, social services and the environment.

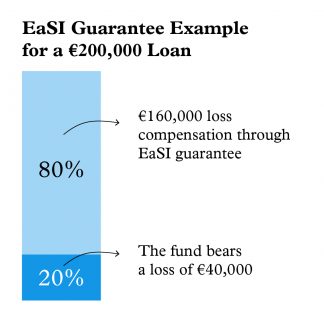

The fund was launched in 2019 as the first-ever impact fund in Germany to receive the EU level EaSI Guarantee from the European Investment Fund (EIF) (FASE 2020, p.26). The fund’s application process took two years, but once the guarantee was signed, the risk-sharing mechanism played an essential role in the establishment and success of the fund.

The EaSI Guarantee covers up to 80% of initial losses of investments in social enterprises, with a cap of 20% of the total invested capital of the fund. This means that the guarantee covers losses of the fund’s investment of up to €3.2 million of the fund’s target volume of €20 million (FASE 2020). Moreover, the EU guarantee is connected to the investment period of the fund. The fund is structured as a closed-end fund with a five-year investment period and a five-year portfolio period.

During the five-year investment period the investors look for the SEs to be invested and make the first round of investments. After this phase, the five-year portfolio period starts and the investors focus on the portfolio that was built to assist the SEs of the first five-year investment period. All investments that fall into the investment period are covered. However, investments could even default to the portfolio period having a second five-year period. In such cases, investments are covered as well.

ESIIF is appealing as it offers different risk-return profiles – junior and senior tranches - and the EU level risk-sharing instrument attracts German investors interested in deploying capital for positive social change who might have otherwise been reluctant to commit to a risky investment.

EaSI Guarantee

The EaSI Guarantee is a financial instrument under the EaSI Programme and it is managed by the European Investment Fund (EIF) on behalf of the European Union. The Guarantee is part of the Microfinance and Social Entrepreneurship axis, one of the three thematic pillars under EaSI. The EIF provides first-loss capped guarantees and counter-guarantees to support financial intermediaries covering loan portfolios of up to €25,000 in microfinance for vulnerable groups starting a business and up to €500,000 for social entrepreneurship. Thanks to the risk-sharing between the financial intermediaries, the EIF and the European Commission, the EaSI Guarantee Instrument enables selected microcredit providers and social enterprise finance providers to expand their outreach to underserved micro and social enterprises, both in their start-up and development phases. The new InvestEU programme builds on this success with the renewal of the guarantee under the Microfinance and Social Entrepreneurship Portfolio for the 2021-2027 period. The EIF offers credit risk protection to financial intermediaries with a capped (counter-)guarantee for transactions of up to €2m to social enterprises (a significant increase compared to the previous instrument).

How does the fund work?

The ESIIF is passively managed by an experienced partner, the avesco Financial Services AG’s subsidiary avesco Management GmbH. It is a matching fund, meaning that certain criteria must be met. Notably, European early-stage social enterprises active in any impact sector must have already reached proof of concept, seek to achieve a measurable social and/or environmental impact, are scalable and aim for further growth capital to scale in the future (e.g. subordinated loans). Once these criteria are met, the fund can double the financing amount that an early-stage social enterprise receives from one or several direct investors.

COVID-19 impact

The COVID-19 pandemic has caused a global economic and financial crisis. In order to encourage investors to keep on financing social enterprises during the pandemic, the European Commission and EIF have launched specific measures to increase the EaSI Guarantee rate to 90% until the 31st of December 2021. Thanks to the EU backing, FASE has successfully closed two of the fund’s rounds of investments during the pandemic, with the last round still ongoing. So far, the ESIIF is funding ten investments with a total volume of EUR 3.35 million in 2021.

How can investors replicate this in future?

The EU will strengthen its support for repayable and non-repayable finance during the 2021-2027 period. The new InvestEU and European Social Fund Plus (ESF+) funding programmes are being rolled out this year, and will build on previous successes and best practices in past public-private partnerships.

InvestEU is expected to boost social impact and innovation with the mobilisation of private capital for social enterprises in different stages of development. It targets four policy areas, one of which is Social Investments and Skills with a budget of €2.8 billion.

The EIF has recently released the InvestEU call for expression of interest for its new guarantee products and the ESF+ has just renewed the fund for Transaction costs to support social finance intermediaries. These are two key opportunities for social investors to replicate FASE’s experience with the EaSI Guarantee and the EaSI transaction cost fund.

Unlocking EU funds for Social Economy

Stay tuned for more case studies on access to finance and public-private partnerships. These learnings will also feed into a Bootcamp on access to EU funding during EVPA’s Impact Week, taking place in Brussels from 30 November to 2 December.

Further Reading

- EVPA (2021), Policy Brief - The EU Budget for Investors for Impact: ESF+ and InvestEU, November, Brussels.

- EVPA (2021), Position Paper - Towards the EU Action Plan for Social Economy: EVPA’s 5 recommendations, July, Brussels.

- EVPA (2021), 2020 Investing for Impact Survey, February, Brussels.

- EVPA (2020), Policy Brief - InvestEU: How to Actively Engage in the Process?, February, Brussels.

- EVPA (2019), Policy Brief - The New EU Multiannual Financial Framework 2021-2027, January, Brussels.

- FASE (2020), EU Project Report 2020 - Developing the Social Enterprise Finance Ecosystem: Building an open, pan-European pipeline of investment-ready, early-stage social enterprises with customized deal-by-deal support, a project mandated by the European Commission under the EaSI 2014-2020 scheme.

- OECD/EU (2017), Boosting Social Enterprise Development: Good Practice Compendium, OECD Publishing, Paris.