Building a Sustainable Social Finance Market in Spain

Unlocking EU Funds for Social Economy - Blog Series

New opportunities for impact!

The European Union mobilised €2.5 billion to support the social economy between 2014 and 2020. The new EU Social Economy Action Plan aims to further increase the funding available for the next six years.

How can social investors make use of EU funds to better support social enterprises and the social economy?

Creas succeeded in doing this, and their example is highly instructive for social investors. Understanding the allocation of previous EU funds can help social investors tap into new opportunities under the InvestEU and ESF+, the two main EU funding schemes dedicated to the social finance sector.

Unleashing the Transformative Power of Impact Funds in Spain

Social impact funds are key actors in achieving the ambitious UN Sustainable Development Goals by 2030 and the European Pillar of Social Rights. For many European nations, this process is underway, but Spain presents an especially illustrative case.

The Spanish impact investment market is growing, both in terms of assets under management and financing actors (Spain NAB 2021). However, Spain only has six social impact funds investing in Spanish social enterprises (Santamarta et al. 2021).

Public-private partnerships can play a key role in promoting an enabling ecosystem for the proliferation of these actors. Creas represents a premier example of how to achieve this aim.

Established in Madrid in 2008, Creas is one of the pioneering impact investing organisations. It is a hands-on investor, financing social enterprises and working closely with them to maximise the social and environmental impact.

Creas started investing through its foundation and later launched two additional impact investing vehicles: the €1.5M Creas Desarolla and the €30M Creas Impacto FESE, S.A. The team is now planning to launch a managing company and a new impact fund in 2023, the €100M Creas Impacto II.

Thanks to EU funding schemes, Creas was able to quickly become a €30M fund manager in 2018 with the launch of Creas Impacto and to aspire launching a €100M fund today.

The success of Creas Impacto

Creas Impacto FESE, S.A., is a self-managed closed-end fund using social venture capital as an investment instrument to guarantee economic return and a positive social impact. It became the first Spanish impact fund under the European regulation, the European Social Entrepreneurship Fund (EuSEF), and to acquire the B Corp label (Creas 2021) Creas Impacto invests in businesses that create innovative and scalable solutions that are empowering people through education and inclusive employment, transforming care for underserved communities, and regenerating our planet and economy.

The companies in its portfolio are mostly in the early growth stage. As a result, the fund provides Series A/B funding with investments ranging from €1M to €3M. 80% of investments go to Spanish companies and 20% to companies in other EU countries. These are carried out through equity and quasi-equity investments. Creas also works to add value to its investees by working with them on strategy, talent and funding from an impact perspective as well as providing access to their network.

The fund is currently ending the investment phase with over 70% of its capital deployed in 10 companies, with 1 exit and 9 portfolio companies. In 2021, its portfolio recorded over €50M in revenues and counted with almost 700 employees.

EU Support: Capacity-Building First!

In 2017, Creas was granted the EaSI transaction cost support to social enterprise finance (2014-2020) to set up Creas Impacto. This EU-level funding is aimed at catalysing smaller risk-capital investments (<€500,000) to social enterprises that otherwise would not happen due to the disproportionally high transaction costs to investors.

The grant was part of the European Programme for Employment and Social Innovation (EaSI), a financing instrument managed by the European Commission from 2014 to 2020. The program’s main goal was to develop the social finance market to improve access to finance for social enterprises that promote equality and sustainable employment, decent social protection and working conditions, and combat social exclusion and poverty in the EU.

The EaSI fund served as a capacity-building grant, as it gave Creas resources to hire a new team to conduct the market analysis and evaluate whether there was enough deal flow to create a larger impact fund in Spain. Moreover, the EaSI was essential to allow the continuation of Creas’s investments in social enterprises while the new fund had not reached the necessary target size to be economically sustainable solely through its management fee (European Commission 2018).

In the first stages of setting up the fund, the new team was able to secure a significant amount of investors from Creas’s first fund (Creas Desarolla), clearing the path for Creas Impacto to become the first European Social Entrepreneurship Fund (EuSEF) in Spain.

The objective of EuSEF (Regulation (EU) No. 346/2013, revised by Regulation (EU) 2017/1991), is to provide a label for social impact funds with the goal to improve their visibility and consequently channel more investments to social enterprises. EuSEF Funds must meet certain criteria set by the European Commission, otherwise they can lose the label – and, more importantly, the validation it confers (EVPA 2018; EPRS 2017).

The EuSEF label built trust between Creas Impacto and potential funding entities. The label was of particular value when, in 2018, Creas Impacto applied for – and earned – additional funding from the Social Impact Accelerator (SIA), a fund of funds managed by the EIF. Creas Impacto had the necessary capacity to successfully navigate SIA’s rigorous due diligence process.

SIA support lets new fund managers thrive

The SIA encourages new funds that could make a solid contribution to developing the impact investment market in their respective countries. Creas’s ambition to build a €30M fund with a new and inexperienced team turned into a success with the support from the EIF and SIA.

The SIA has resources dedicated to assisting and advising new teams and fund managers during the structuring of the fund and fundraising phase. Notably, the EIF worked closely with Creas on the due diligence process for SIA, the market analyses, the governance, the legal structure, the financial model and the investment decision-making. It has also supported Creas to find the ideal balance between the initial ticket size offer and the reserved capital for follow-ons.

Finally, the EIF organises events to promote networking and knowledge-sharing for all SIA-backed funds in Europe. Creas had the opportunity to develop very close ties with its peers across the EU and meet regularly to exchange their learnings, challenges and best practices.

The SIA drives Pan-European Public-Private Partnerships

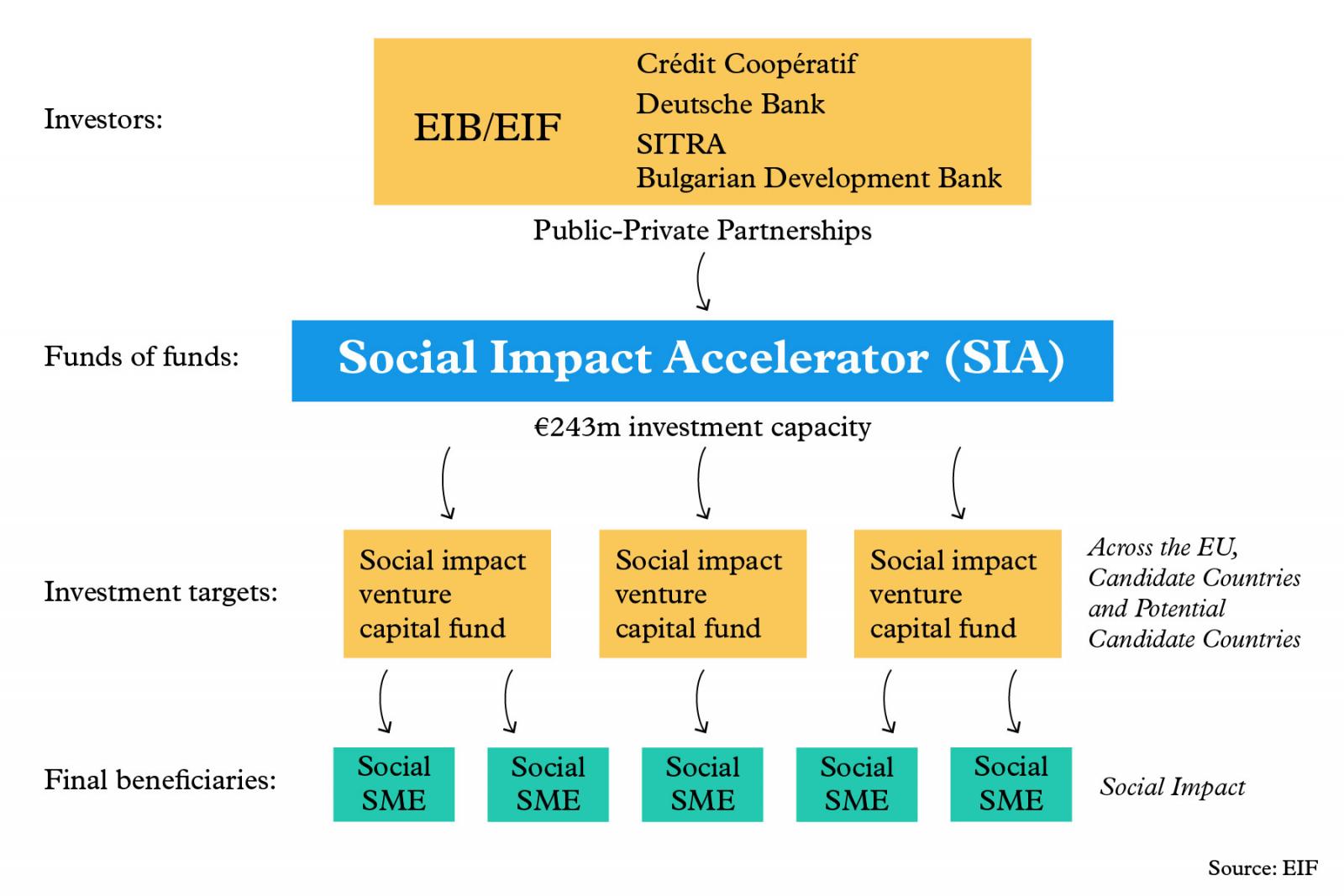

The Social Impact Accelerator program became the first pan-European public-private partnership of the EIB Group (European Investment Bank and EIF) to address the social market need for equity and quasi-equity finance. The SIA was conceived in 2013 to be a fund-of-funds focused on building a sustainable market for social impact investing at a pan-European level. The main goal is to improve access to finance for social enterprises to promote entrepreneurial solutions to social challenges. The EIF selects the social impact funds financing commercially viable social SMEs in the EU, reporting on their social impact and offering supplementary advisory support to investees.

The Social Impact Accelerator has a budget of €243M, coming from the EIB Group and external investors, including Crédit Coopératif, Deutsche Bank, the Finnish group SITRA and the Bulgarian Development Bank (BDB). Until December 2018, the EIF had committed €148 million to 14 impact funds across eight Member States (UK, France, Germany, Italy, Denmark, the Netherlands, Spain and Belgium). In turn, impact funds supported a total of 140 social enterprises at different stages of development and across a variety of sectors.

Since then, the Social Impact Accelerator has increased funding available to social enterprises in the EU beyond initial expectations. At the end of 2018, SIA-backed funds made available approximately €580 million, four times the amount invested by SIA, while the amount invested in the 140 social enterprises was three times the value disbursed by SIA. In Creas Impacto’s case, the presence of the EIF as the lead investor has attracted many new private investors. The SIA invested €15M into the fund aiming to raise between €20-25m in total (EIF 2018; EIF 2020). The fundraising period exceeded all expectations, reaching €30M.

The crowding in investments exemplifies the EIF’s role as a professional and trusted institutional investor and its capacity to bring additional capital when necessary. Moreover, the SIA guarantees the quality and credibility of its funds, due to its rigorous due diligence and two additional factors, worth examining in detail:

- The social impact-based carry mechanism: This mechanism foresees that fund managers are only entitled to receive the carried interest if, in addition to achieving financial performance, the fund achieves certain social impact targets. Like all SIA-backed funds, Creas Impacto is required to adhere to the mechanism.

- Impact measurement methodology: SIA also requires fund managers to follow an impact measurement methodology using predefined indicators and targets set at the social enterprise level and then aggregated at the fund level, through predefined weightings for each indicator (EIB 2020).

Key ways social investors can replicate this success story

The EU will strengthen its support for repayable and non-repayable finance during the 2021-2027 period. The new InvestEU and European Social Fund Plus (ESF+) funding programs are rolling out this year and will build on previous successes and best practices in public-private partnerships.

InvestEU is expected to boost social impact and innovation with the mobilisation of private capital for social enterprises in different stages of development. It targets four policy areas, one of which is Social Investments and Skills, with a budget of €2.8 billion.

Social investors can access the financial products under the InvestEU by engaging with its implementing partners. The EIF and EIB Group are the most important partners, managing about 75% of the InvestEU guarantee.

The EIF has recently released the InvestEU call for expression of interest for its new equity product targeted at financial intermediaries, including social impact funds. The EIF will provide equity investments and co-investments to, or alongside, funds in the areas of venture capital, private equity and private credit (see in detail who is eligible). Moreover, the ESF+ has renewed the fund for transaction costs to support social finance intermediaries. These are two key opportunities for social investors to replicate Creas’s experience with the EaSI transaction cost support fund and EIF’s equity investment.

Please visit our EU Funding Watch page for more information on upcoming deadlines. If you’re seeking additional guidance on accessing EU funding opportunities, please reach out to Bianca Polidoro, EVPA Senior Policy and EU Partnerships Manager.

Unlocking EU funds for Social Economy

Stay tuned for more case studies on access to finance and public-private partnerships. These learnings will also feed into a Bootcamp on access to EU funding during EVPA’s Impact Week, taking place in Brussels from 30 November to 2 December.

Further Reading

EVPA (2018), Policy Brief - How EuSEF’s Recent Reform can Impact the VP/SI Sector, June, Brussels.

EVPA (2019), Policy Brief - The New EU Multiannual Financial Framework 2021-2027, January, Brussels.

EVPA (2020), Policy Brief - InvestEU: How to Actively Engage in the Process?, February, Brussels.

EVPA (2021), Policy Brief - The EU Budget for Investors for Impact: ESF+ and InvestEU, November, Brussels.

EVPA (2021), Position Paper - Towards the EU Action Plan for Social Economy: EVPA’s 5 recommendations, July, Brussels.

Global Steering Group for Impact investment (2018), Building impact investment wholesalers – key questions in Design of an impact investment wholesaler, Working Group Report, October.

Hehenberger, L. (2021), Impact Investing Trends In Spain: The Way Forward, December 13, Esade Business & Law School, Forbes.

Hehenberger, L., Casasnovas, G., Jenkins, S. (2021), La inversión de impacto en España 2020: Oferta de capital, segmentación y características, June, Esade Business & Law School and Spain NAB.