Read more

Impact investors, a diverse set of actors who focus on driving measurable positive impacts for people and planet, have the power to mobilise resources to solve the social and environmental challenges we face.

Impact investors are impact funds, foundations, corporate impact actors, public funders, pension funds, insurance companies and other asset owners, banks and other financial institutions. We are diverse but united in our ambition to deliver impact that would not have happened otherwise. The strategies may range within impact investing, but all these parties intend to generate measurable social and environmental change. And all investors have potential to become impact investors.

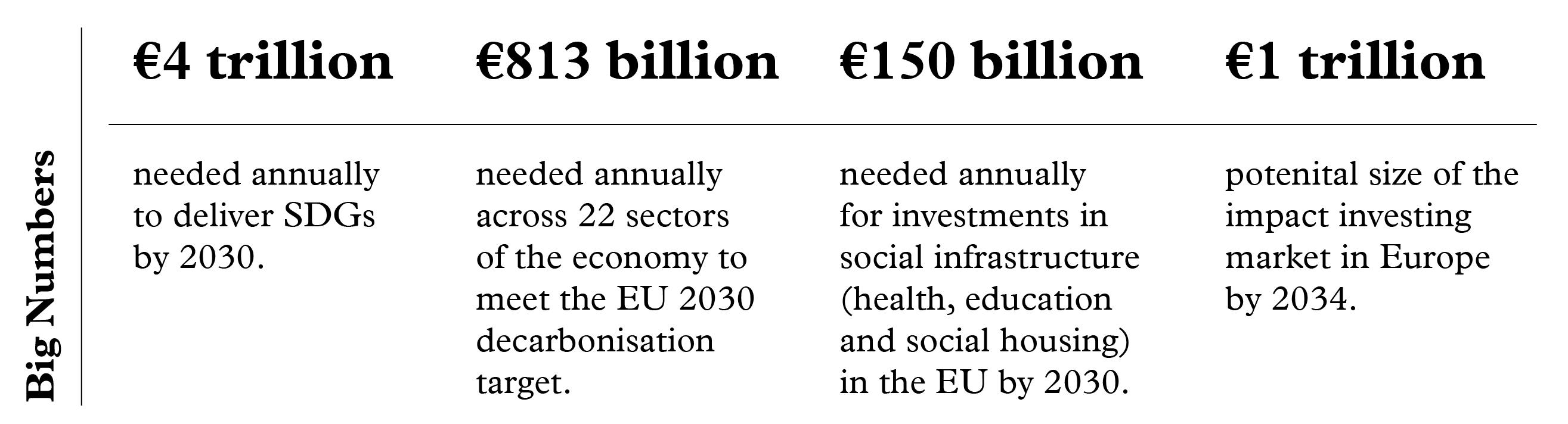

Impact investing has become one of the fastest growing areas of investment in the financial industry: people want money to work for good. If we manage to keep the pace, impact investing can hit one trillion by 2034, and grow its mainstream market share from one to ten percent. That big ‘if’ depends on an enabling policy framework, well-tailored public funding and continued agility and innovativeness among all impact stakeholders. That means a joint effort between impact capital providers, impactdriven companies and social enterprises; investable solutions and capital mobilisation along the continuum are the results.

Market growth is driven by countries with favourable regulations, such as France and the Netherlands, which have democratised access to impact investment and mobilised significant resources from retail investors, who are increasingly demanding sustainable and impact opportunities.

We need to accelerate the influx of impact capital now to finance the gap to deliver on the Sustainable Development Goals by 2030 (still at €4+ trillion annually) and a just transition to a low-carbon economy.

Impact investors are instrumental in bridging this gap because they put impact at the centre of their decisions. They deploy catalytic capital that can help breakthrough solutions emerge and scale to foster lasting positive change – from early medicines discovery to regenerative agriculture, from gender-lens entrepreneurship to inclusive AI, from financial inclusion to digital access, from climate adaptation to mental health, from circular fashion to urban regeneration, from food innovation to green mobility. Their role as patient and early-stage investors can also de-risks investments and can attract follow-on funding in these areas of intervention.

Building a resilient and competitive European economy that fosters innovation and provides opportunities for all can only happen if EU policies enable more impact capital to be deployed and more impact actors to join the movement. The EU must harness the transformative power of impact investors to accelerate the transition to a more competitive, innovative, sustainable and inclusive economy.

To this end, we call on the EU to:

1> Put impact at the centre of EU policymaking

EU policies have the power to enable impact investors to do what they do best: serve society by intentionally investing to create a positive and lasting environmental and social impact. We are ready to work together with EU policymakers to prioritise an enabling policy framework that (a) unlocks private capital for impact

2> Make all EU funding impact funding

EU funding should lead by example. We call for all the European Union’s public money to be intentionally impactful; and for the creation of an impact scoreboard that would assess the impact created by deploying EU public capital, including through public procurement.

3> Deliver on the Sustainable Development Goals by 2030

We need the European Union’s renewed commitment to Sustainable Development Goals and green transition targets. We call for a European Year of Impact in 2030, to celebrate achievements, learn lessons and set new ambitions for people and planet!

To track progress and ensure impact is high on the agenda, we call for the establishment of an Impact, Sustainable & Long-term Investments Intergroup in the next European Parliament. We also urge the Parliament to strengthen the impact investors’ role within the re-established Social Economy Intergroup.