How the EU Supported a First-time Impact Fund in Portugal

Unlocking EU Funds for Social Economy - Blog Series

New opportunities for impact!

The European Union mobilised €2.5 billion to support the social economy between 2014 and 2020. In December 2021, the European Commission adopted the new EU Social Economy Action Plan which commits to supporting social investors through increased EU repayable and non-repayable finance for the years to come.

How can social investors make use of EU funds to better support social enterprises and the social economy?

MAZE, a pioneer impact investing firm in Portugal, offers a compelling answer to this question. The firm co-invested with the EU through its first impact fund, the €45M Mustard Seed MAZE Social Entrepreneurship Fund I (MSM). MAZE’s case is highly instructive for social investors across Europe, especially those seeking to replicate past successes.

Understanding the allocation of previous EU funds (2014 - 2020) can help social investors tap into new opportunities under the two main EU funding schemes dedicated to the social finance sector from 2021 to 2027, the InvestEU and ESF+. Both programs have already released new financial instruments and grants.

Learnings from MAZE bridge past and present. While many of the EU funding opportunities MAZE leveraged have now run their course, there are many new opportunities now available to replicate the successes detailed here.

Who is MAZE?

In 2013, Antonio Miguel, currently the Managing Partner at MAZE, decided to co-launch the impact investing firm in collaboration with the Calouste Gulbenkian Foundation. Antonio had built a career creating a positive impact through finance, mainly in the UK, but with MAZE, he sought to apply his expertise in his home country of Portugal. At the time, Portugal’s social finance market was still emerging.

Antonio was able to mobilise public and private stakeholders to help build the social finance market with the support of the Calouste Gulbenkian Foundation (MAZE’s founder, main partner and key funder) and a team of millennials inspired by the idea of changing the world.

Now, MAZE engages in a wide range of impact investing activities. The firm has partnered with the public sector for the creation of social impact bonds and runs the MAZE-X acceleration program to assist impact start-ups. MAZE became an asset manager with the launch of the MSM fund in 2018.

MSM fund at a glance

With the experience accumulated through the acceleration program MAZE-X, the team realised the need for improving access to finance for technology-based impact ventures in Portugal. For this reason, MAZE joined forces with Mustard Seed, an impact investing firm based in the UK, to launch the first social impact fund in the country.

The MSM fund is now a €45M venture capital instrument providing equity products to support early-stage impact ventures that are scaling their solutions across Portugal and Europe (except for the UK). It invests from idea to growth, providing pre-seed to series A funding. Besides offering funding, the MSM fund supports its portfolio companies with access to talent and investor networks and helps them build impact measurement and management capacity.

To be eligible, portfolio companies must be innovative enterprises using technology to solve social and environmental challenges with the potential for rapid growth. In addition, they must be lock-step businesses, meaning that their revenue models are intrinsically linked to the impact they create.

The fund is currently in the capital deployment phase for the next two and a half years and is looking to invest in new deals. In the first quarter of 2022, the MSM fund has already invested in 26 new ventures and 12 follow-on investments, with c. €20M of capital deployed so far and one exit out of the 38 investments.

The start-up Kitch exemplifies the impact promoted by the MSM fund. The Lisbon-based enterprise was MSM’s first investment in 2019 and the first portfolio company to exit at the end of 2021. Kitch’s software platform aims to reduce the carbon footprint of the online food industry by connecting restaurants and clients. “Having a strong impact angle to what you are doing can help you build a lot of enterprise value,” according to Antonio.

Kitch is just one of many diverse cases from the MSM fund’s portfolio that was possible thanks to public-private partnerships.

From EU support to impact acceleration

EU support has been very present throughout MAZE’s life. Different EU grants have helped the organisation to test new ideas and improve its services for the impact ecosystem. The same held true when it came to launching the MSM fund. In October 2018, the EIF signed an agreement with MAZE to co-invest in the MSM fund with two equity products under the Social Impact Accelerator (SIA) and the InnovFin Equity Facility (EIF 2018).

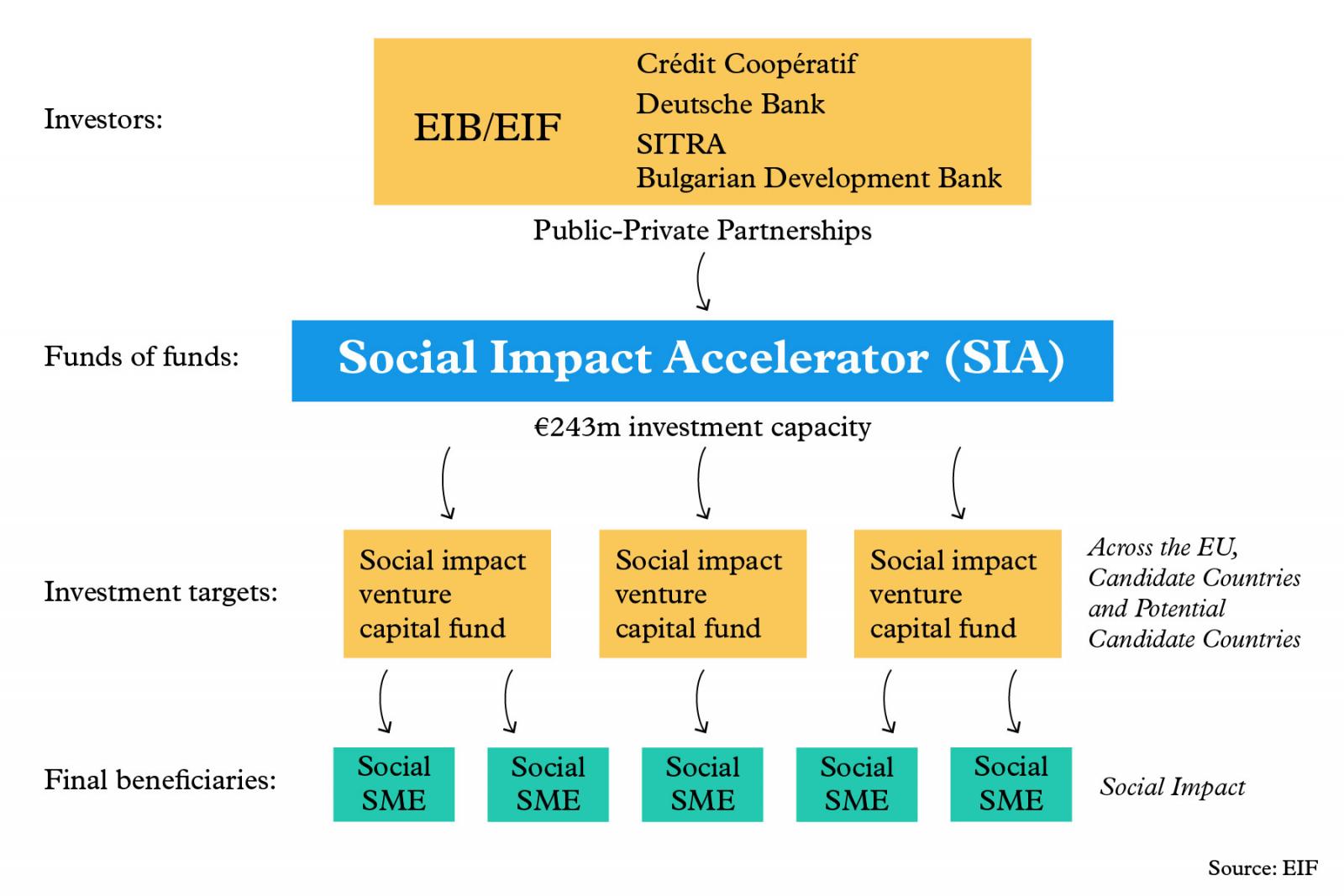

In 2013, the EIB Group launched the SIA, a fund of funds dedicated to building a sustainable market for social impact investing at a pan-European level. It became the first pan-European public-private partnership of the EIB Group (European Investment Bank and European Investment Fund) to address the social market need for equity and quasi-equity finance. The fund had a budget of €243M coming from the EIB Group and external investors, including Crédit Coopératif, Deutsche Bank, the Finnish group SITRA and the Bulgarian Development Bank (BDB).

The SIA supported new funds that could make a solid contribution to developing the social investment market in their respective countries. This was the case when MAZE, a key market builder in the Portuguese impact ecosystem, decided to launch its first fund. In 2019, the EIF invested through SIA €12,5M in the MSM fund, which became the first impact fund in Portugal.

Besides fostering emerging markets, the SIA helped strengthen new teams and funds. Rita Casimiro, Partner at MAZE, believes that the EIF’s due diligence and support “felt like an accelerator program” for the newly formed team. Through this partnership, MAZE created a strong value proposition that was up to market standards. Without previous experience, funds can take much longer to reach that same capacity level on their own.

The EIF organised networking and knowledge-sharing events for all SIA-backed funds in Europe. This allowed the MSM team to develop very close ties with peers across the EU and meet regularly to exchange learnings, challenges, and best practices.

The SIA had a catalytic effect on the social enterprise market in the EU. Through the program, which ran from 2013 to 2018, the EIF committed €148 million to 14 impact funds across eight Member States (UK, France, Germany, Italy, Denmark, the Netherlands, Spain and Belgium). In turn, impact funds supported a total of 140 social enterprises at different stages of development and across a variety of sectors (EIB Group 2020).

The SIA attracted funding to social enterprises in the EU beyond initial expectations. By the end of 2018, SIA-backed funds had made available approximately €580M to social enterprises, four times the amount invested by SIA. The amount invested in the 140 social enterprises was three times the value disbursed by SIA (EIB Group 2020).

As an experienced institutional investor with rigorous due diligence, the EIF conferred credibility to the funds it supported. SIA-backed funds, including the MSM fund, have experienced a crowding-in of private investments due to the presence of the EIF as a lead investor. Antonio and the MAZE team were able to attract the cornerstone and many other private investors once the EIF joined the fund. This was particularly important considering that first-time funds often encounter barriers to achieving a target size of €45M without a previous track record.

Part of the credibility of SIA-backed funds in the market also comes from these funds’ commitment to the impact mandate. The EIF only selected social impact funds that provided financial and non-financial support to commercially viable social enterprises in the EU. Moreover, it required funds to implement an impact measurement methodology and a social impact-based carry mechanism – when the carried interest depends on the financial and impact performance of the fund – along with reporting on the final social impact.

Closing the gap

As part of the agreement with the EIF, the MSM fund also received an investment of €5M from the InnovFin equity product under the early-stage SME window. In total, the EIF contributed €17.5M, which accounts for 38,8% of the fund, through the SIA and the InnovFin funding programs.

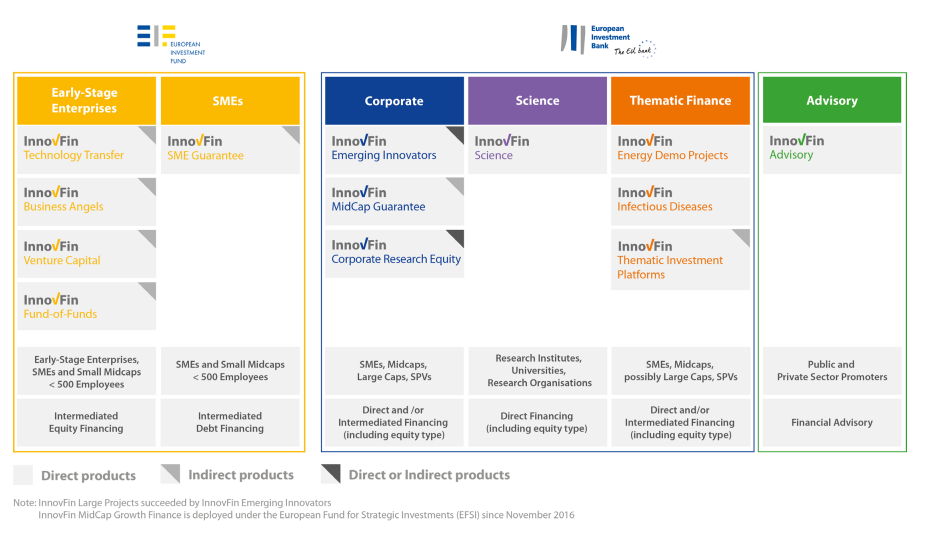

InnovFin, the EU Finance for Innovators Program, was an initiative launched by the European Investment Bank Group (EIB and EIF) and the European Commission (EIF 2022). The program was funded by the Horizon 2020, the EU Research and Innovation (R&I) programme available from 2014 until 2020, as well as the European Fund for Strategic Investments (EFSI) available from 2015 until 2020, the heart of the Investment Plan for Europe.

InnovFin offered a range of tailored financial and advisory products (loans, guarantees and equity) designed for R&I-driven entities and companies in different stages of development. It also provided several thematic products to address specific financing needs of certain sectors.

In the case of InnovFin Equity, the main goal was to facilitate and accelerate access to finance for innovative businesses covered by the Horizon 2020 thematic areas – e.g. development of technologies to solve social issues – that were facing significant financing gaps due to their riskier nature. InnovFin focused on early-stage enterprises and offered different products to the whole spectrum of early-stage investing.

The EIF’s investment strategy of pulling resources from the Social Impact Accelerator and InnovFin programs funded almost 40% of the MSM fund. The co-investment with the EU was instrumental to the launch of MSM, particularly in attracting other private investors, and ultimately improving access to finance for tech-driven social start-ups in Portugal and Europe.

Investing in capacity-building

In 2019, after a year of operation, MSM engaged yet another EU funding opportunity, this time aimed at building capacity. The EaSI transaction cost support to social enterprise finance (2014-2020) catalysed smaller risk-capital investments (<€500,000) to early-stage social enterprises that otherwise would not happen due to the disproportionally high transaction costs to investors.

The grant was part of the European Programme for Employment and Social Innovation (EaSI), a financing instrument managed by the European Commission. The program’s main goal was to develop the social finance market and improve access to finance for social enterprises that promote equality and sustainable employment, decent social protection and working conditions, and combat social exclusion and poverty in the EU.

In practice, the EU funding helped the MSM team to lower the investment transaction cost, dedicate part of the budget to invest in the capacity building of the new team and improve the quality of their services. For instance, MAZE was able to invest in new personnel, software, and expertise. In turn, they had enough resources to develop investment readiness sessions for founders, travel to meet with potential co-investing partners and support the portfolio companies in their impact measurement and management.

How can today’s investors replicate this success story?

MAZE’s story is full of examples where EU funding fostered the acceleration of impact. Now that the funding instruments MAZE benefited from have run their course, social investors must look to new programs to fulfil their needs. Luckily, those programs not only exist, but they are also in many cases an upgrade to a first iteration.

Two new EU funding programs available for social investors, the InvestEU and the European Social Fund Plus (ESF+), are rolling out this year and will build on the success of previous EU funding programs. Both programs are available until 2027.

InvestEU brings 14 previous EU financial instruments, including InnovFin, under one roof. This consolidation aims to make access to EU finance simpler, more efficient and flexible. With the end of the Social Impact Accelerator (SIA), InvestEU will also provide for the social finance market’s need for equity instruments.

Social investors will be able to access these instruments under the Social Investments and Skills window of the InvestEU, with a budget of €2.8 billion, by engaging with its implementing partners. The EIB Group is the partner managing about 75% of the InvestEU guarantee, together with 25% managed by national promotional banks and international financial institutions, such as the Bank for Reconstruction and Developments (EBRD) and the Council of Europe Bank.

The EIF’s call for expression of interest for the equity products under the InvestEU are already available for financial intermediaries, including impact funds, in the areas of venture capital, private equity and private credit (see in detail who is eligible).

The European Social Fund Plus (ESF+), replacing the previous ESF (2014-2020), is the main funding program strengthening the social dimension of the European Union. The ESF+ has brought the Employment and Social Innovation (EaSI) strand under its umbrella with a €762M budget managed by the European Commission.

EaSI continues to support social enterprises and the emerging social investment market, enabling improved employment and skills, labour markets and labour mobility, social protection and active inclusion and working conditions in the EU. To access this funding opportunity, investors can find the calls on the EU Funding and Tenders portal.

As shown in this study, EU funding opportunities are constantly developing. If you’re looking to keep apprised of the very latest news, please visit our EU Funding Watch page for more information. If you’re seeking additional guidance on accessing EU funding opportunities, please reach out to Bianca Polidoro, EVPA Senior Policy and EU Partnerships Manager, and Stephanie Brenda Smialowski, EVPA Policy and EU Partnerships Associate.

Next steps

These learnings will also feed into a Bootcamp on access to EU funding, featuring Antonio Miguel as a speaker. The event is part of EVPA’s Impact Week, taking place in Brussels from 30 November to 2 December.

Further Reading

EVPA (2019), Policy Brief - The New EU Multiannual Financial Framework 2021-2027, January, Brussels.

EVPA (2020), Policy Brief - InvestEU: How to Actively Engage in the Process?, February, Brussels.

EVPA (2021), Policy Brief - The EU Budget for Investors for Impact: ESF+ and InvestEU, November, Brussels.

EVPA (2021), Position Paper - Towards the EU Action Plan for Social Economy: EVPA’s 5 recommendations, July, Brussels.

Global Steering Group for Impact investment (2018), Building impact investment wholesalers – key questions in Design of an impact investment wholesaler, Working Group Report, October.

Calouste Gulbenkian Foundation and MAZE (2018), Portuguese Social Investment Taskforce - Progress Report Three years of learning, achievements and new challenges, September.