Navigating IMM with Open Value Foundation

Open Value Foundation – Apadrina un Olivo: Case Study

Overview of the investor for impact

Open Value Foundation (OVF) is a family foundation financed by the family holding Santa Comba. Influenced by its founders 15-years’ philanthropic journey and pioneers such as professor and Nobel-Peace Prize Muhammad Yunus and Acumen’s founder Jaqueline Novogratz, the foundation was born in 2017 with a hybrid approach that combined philanthropic grant-making and impact investment.

Using such a hybrid model, OVF aims at improving the living conditions of the most vulnerable people and communities in Spain and Sub-Saharan Africa, guaranteeing their freedom and free will.

Building on the learnings acquired through this approach, in 2018 Open Value Foundation founders set up the impact investment management firm Global Social Impact Investments (GSII), which manages two impact funds: GSIF Africa, launched in 2019, and GSIF Spain, launched in 2021.

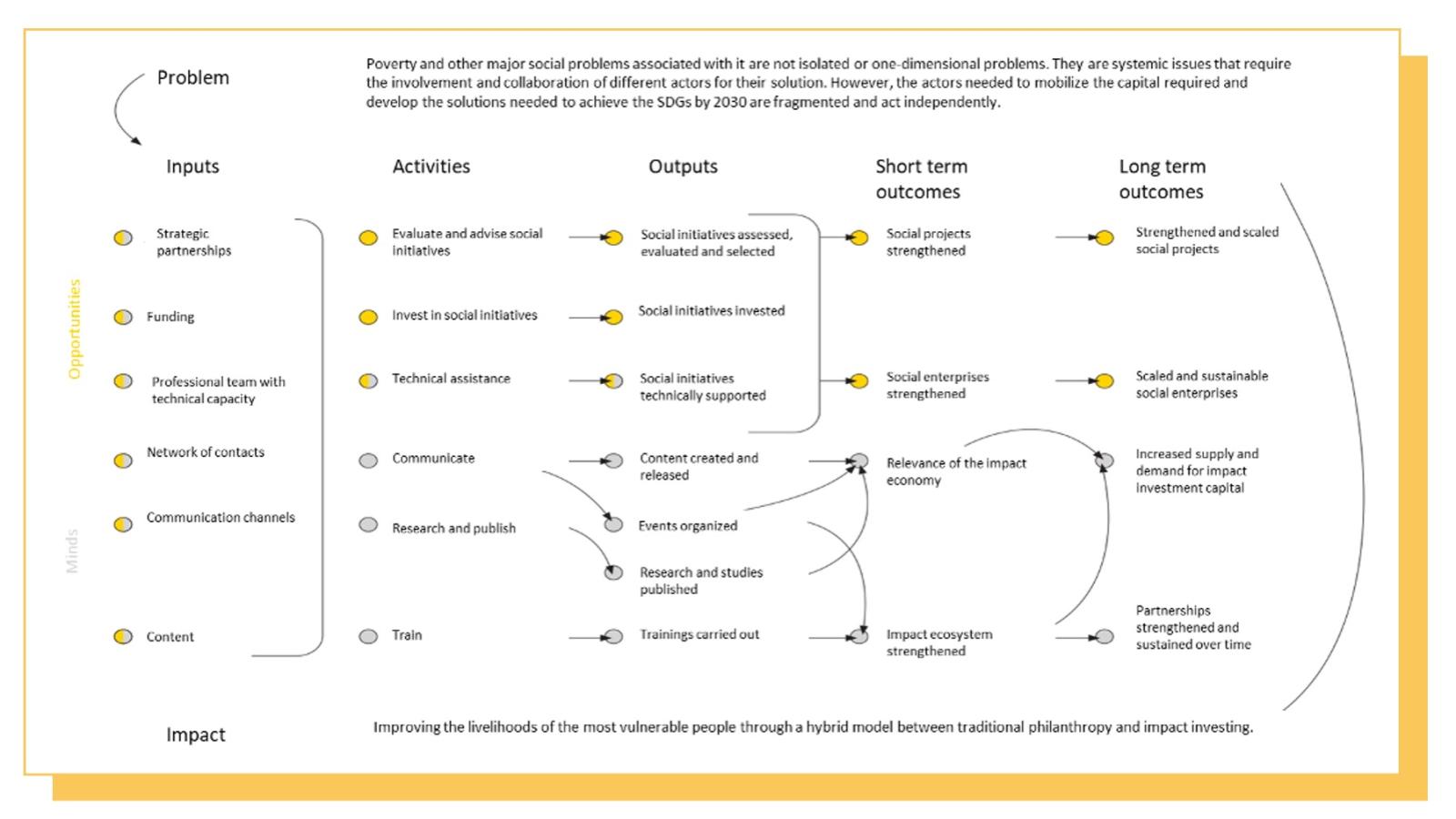

The activity of the foundation can be divided in two areas: opportunities and minds.

Opportunities: allocating resources to serve the most vulnerable

The area of opportunities represents around the 75% the foundation’s investment. It embodies the portfolio of supported organisations, which in turn are solving pressing social issues that affect vulnerable communities.

OVF finances these organisations mainly through grants and loans, and to a lesser degree through equity and hybrid financial instruments. In addition to funding, OVF adopts a highly-engaged approach by providing extensive non-financial support to help the investees strengthen their business model and their impact measurement and management practices.

The foundation provides additional support, backing innovations that would otherwise be underfunded, thereby addressing a gap in the market. Investing with small tickets to early-stage organisations, OVF can have a catalytic role, creating a track record and attracting other types of investors at a later stage.

Minds: achieving ecosystem-level impact

The remaining 25% of the investment of OVF is dedicated to the area of minds. This area is focused on strengthening the impact ecosystem in Spain and beyond, by boosting collaboration with other actors, providing training to organisations and professionals, partnering with universities and participating in events.

Through the Open Value Academy, Open Value Foundation organises a series of courses and trainings to spread knowledge on impact investment to individuals and organisations.

OVF also collaborates with the Acumen Fellows Program in Spain, and has been the first investor of initiatives to strengthen the ecosystem, such as SpainNAB, the ESADE Centre of Social Impact and the chairs on impact investment held at the Universidad Pontificia Comillas and at the Universidad Autónoma de Madrid.

Impact Measurement and Management (IMM): the decision driver of the foundation

The investment strategy of the foundation is based on its Theory of Change (ToC). The foundation was already founded on the basis of its ToC and the impact it aims to achieve: improving the livelihoods of the most vulnerable people through a hybrid model between traditional philanthropy and impact investment.

For OVF, improving the livelihoods of the most vulnerable implies putting beneficiaries at the centre of solutions, which translates into two main investment criteria that have the same weight when making decisions. First, the business model should not have a trade-off between impact and revenue – it should be the closest possible to a lockstep model. Second, the social entrepreneurs should have identified a problem and a subsequent solution.

The Theory of Change of OVF includes the impact at the investor level (opportunities area) and at the ecosystem level (minds area). Each output and outcome identified in the value chain includes a series of indicators that are monitored internally.

The Open Value Foundation's Venture Philanthropy and Catalytic Capital Fund

The Open Value Foundation's Venture Philanthropy and Catalytic Capital Fund was born in 2018 with the purpose of supporting initiatives and social enterprises in seed stage with financial and non-financial support.

In 2021 this fund exceeded EUR 400k, including new funds awarded in 2021 and active loans previously granted.

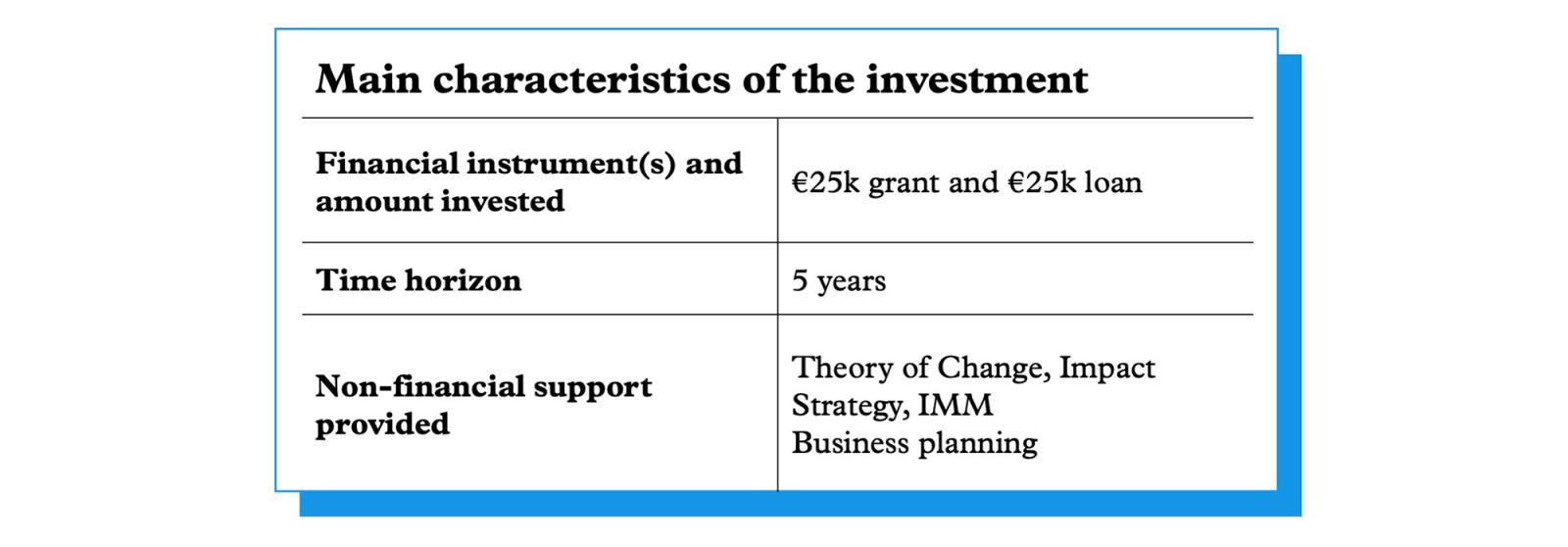

Apadrina un Olivo is part of the Fund’s portfolio. In 2020, OVF invested in this social enterprise, which seeks to transform the neglected state of rural Spain by creating sustainable rural economies, through a grant of EUR 25k and a loan of 25k.

Overview of the social problem (Apadrina un Olivo)

In Spain, 80% of the population lives in 30% of the territory (in provinces like Madrid and Barcelona) whereas the 70% of the territory is occupied by the 20% of population. This phenomenon is popularly known as La España vaciada (the emptied Spain). Depopulated rural areas lack young people to foster their economic activity, and therefore their natural resources are gradually being abandoned.

Apadrina un Olivo is an organisation born in 2014 in the village of Oliete, in the province of Teruel. Five social entrepreneurs (2 of which were from the village) founded this organisation to cover a double gap: 1) the natural resources of the area (olive trees) were getting abandoned and 2) there was an unmet demand for employment by people that would otherwise migrate to other areas.

The social enterprise allows people to “adopt” an olive tree through a website. With an annual contribution of €60, anyone can choose an abandoned tree, give it a name, go to the village to visit it and get 2l of olive oil. Smallholders lease their abandoned trees to Apadrina un Olivo for ten years, so that they can recover them and give 10% of benefit to the smallholders after the fifth year. Furthermore, the organisation sells the olive oil produced through its website.

This business model has a high social and environmental impact. On the one hand, Apadrina un Olivo has revitalised the village, bringing tourism, new workers and economic activity. On the other hand, recovering such olive trees has a deep positive environmental impact, as they store carbon that would otherwise go into the atmosphere.

The journey of Apadrina un Olivo and Open Value Foundation

Open Value Foundation was in its early days when their team met Apadrina un Olivo, whereas the social enterprise had four years of activity. The entrepreneurs had a clear idea of the environmental impact they were having by recovering the olive trees, but OVF rapidly saw the vast social impact potential of the solution.

For OVF, meeting Apadrina un Olivo led to a discussion on what it means to be a vulnerable community in Spain. The employment gap is bigger in rural areas than in big cities, and depopulation brings other social issues, such as lack of social services or economic activity. Furthermore, Apadrina un Olivo employs people with intellectual disabilities, who have an even bigger employment gap in rural areas.

In 2020, OVF decided to invest in Apadrina un Olivo through a grant of €25k and a loan of €25k. In other words, a loan of €50k to which Apadrina un Olivo only had to return half.

Building a Theory of Change

The financial support given from Open Value Foundation came along with a process of technical assistance aimed at strengthening the business model and the impact of the investee.

They started by building a problem tree, through which OVF and Apadrina un Olivo identified the root causes of rural depopulation and its social and environmental consequences, and turned it into a solution tree that included the means and objectives to boost the rural economy. This was a collaborative process, in which both investor and investee learned together about the social problems they were addressing.

After this analysis, they started building the Theory of Change of Apadrina un Olivo. For Apadrina un Olivo, the Theory of Change was crucial for structuring and refining their work, and it became a key document for communicating with other stakeholders.

Understanding stakeholders

Apadrina un Olivo is a project that clearly needs the buy-in from stakeholders to thrive. The lands are leased by smallholder farmers, who are then compensated but, most importantly, understand that this activity is good for the village. A key duty of the social enterprise has been to build trust among smallholders and to find the formula that satisfies their needs.

Prior to the investment from OVF, Apadrina un Olivo realised that even if they were recovering some olive trees, others were getting abandoned, since an oil mill was missing – the nearest one was two hours away. After one year of meetings with the stakeholders, they raised €340k to build the mill. This also gave them the opportunity to create a local olive oil brand which they could sell online.

During the due diligence process, OVF visited the village, the lands, the mill, the workers, the smallholders, new villagers and other stakeholders, and they acknowledged that the entrepreneurs understood the village’s needs.

Assessing risk

As many olive trees in Oliete were already abandoned, the risk of unintended negative consequences of this solution was very low: if the project had failed, there would be very little negative risk for the smallholders. Moreover, being a business model closely integrated with the whole supply chain helps avoid negative externalities.

OVF also looks at financial risk as a type of impact risk: if the project is not financially sustainable in the long term, the social impact can be compromised. In this case, it was the entrepreneur who had identified different scenarios and analysed them along with the investor.

Setting indicators

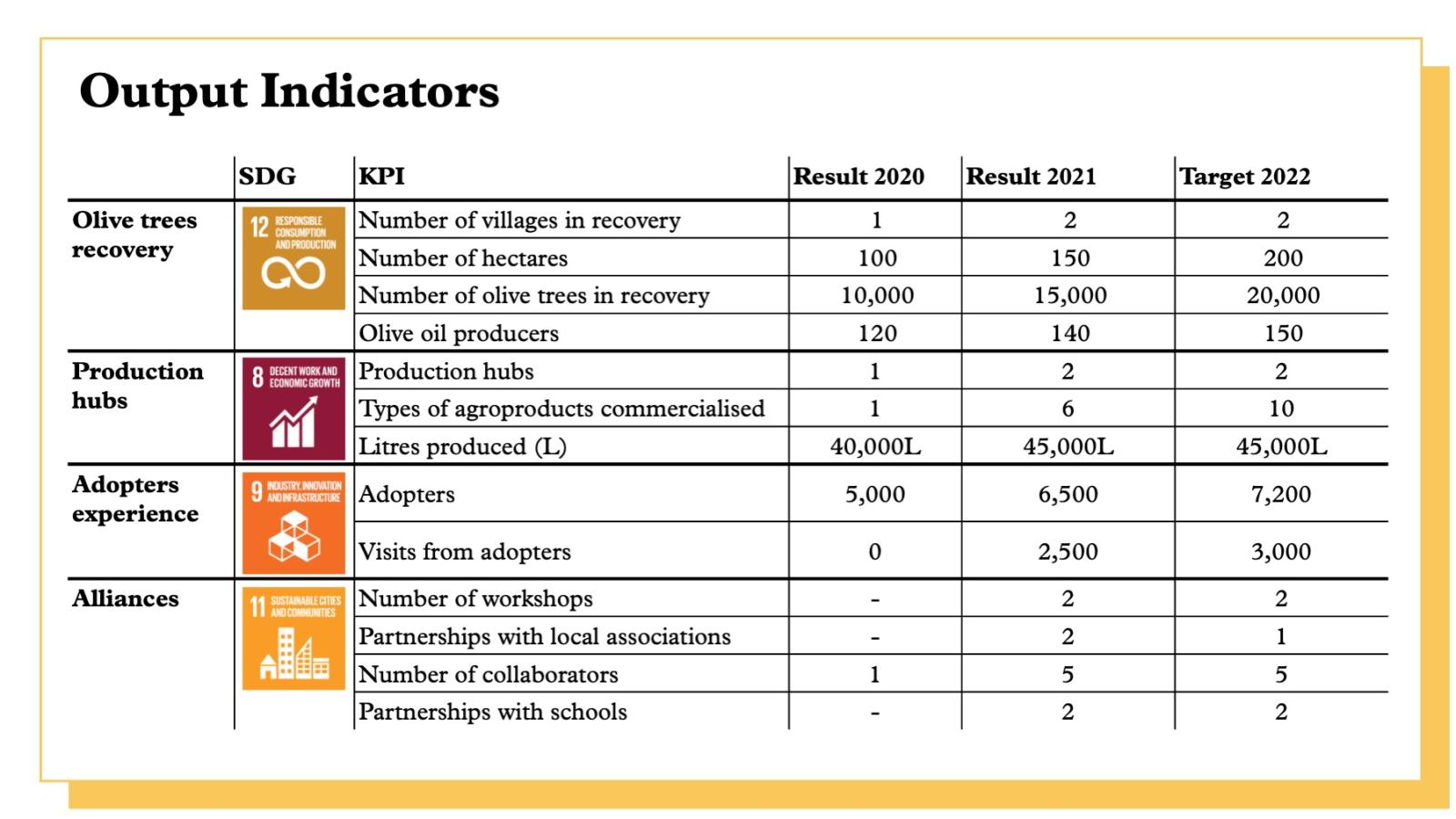

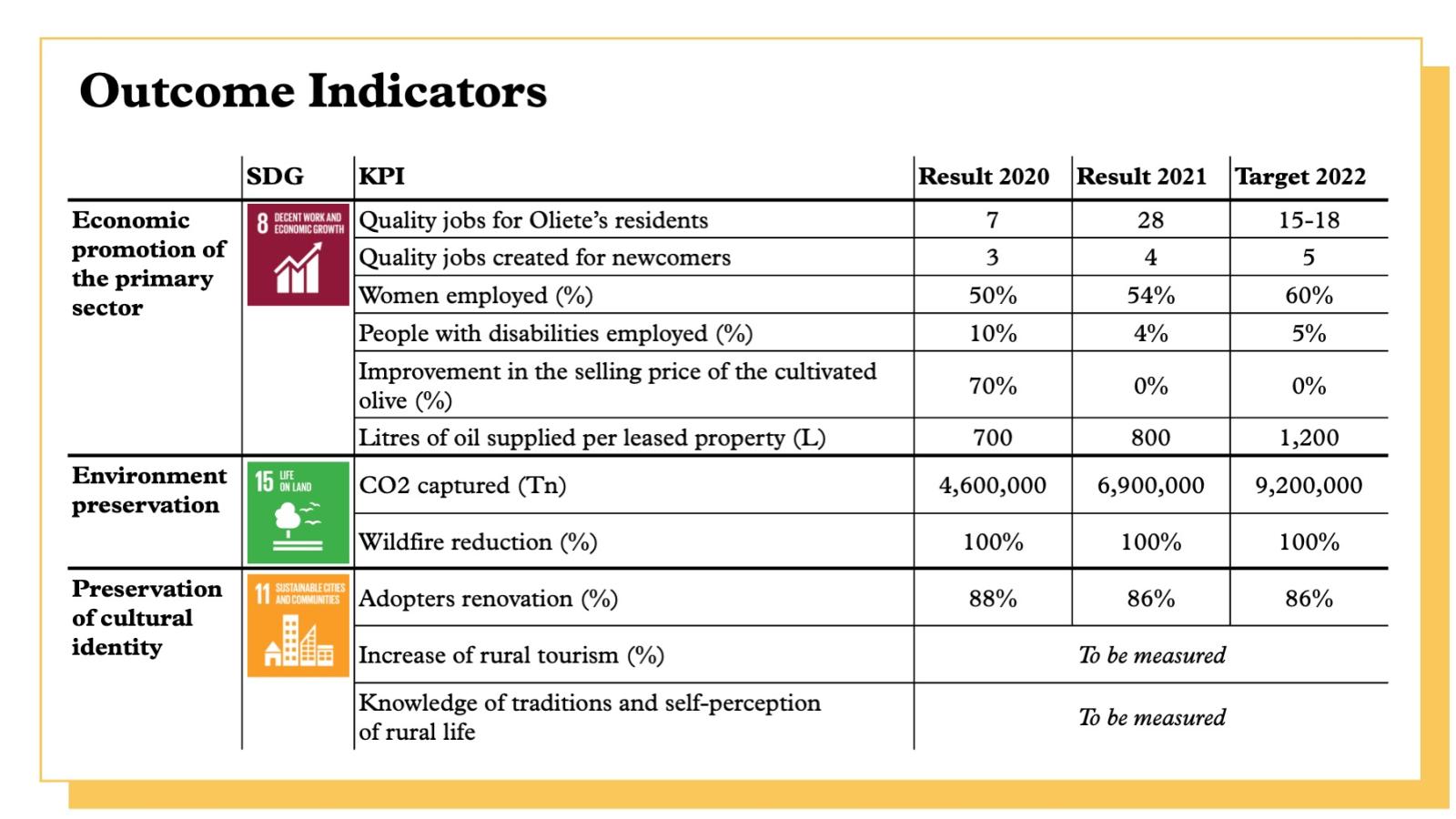

After assessing the stakeholders’ needs and the outcomes to measure, OVF and Apadrina un Olivo set up the output and outcome indicators that would be integrated in the Theory of Change – with their corresponding baselines and targets. Each indicator is also aligned with one SDG.

As OVF’s supported organisations have business models linked to impact (lockstep models), they let the entrepreneur decide the impact targets, as they will be related to the financial performance. Open Value Foundation monitors the percentage of the target achieved and the annual variation from the previous year.

In the case of Apadrina un Olivo, investor and investee agreed on series of output and outcome indicators. Even if the set of indicators is quite extensive, they have been judged to be relevant and feasible to measure for the investee, as they are strongly linked with its business performance and value proposition. Output indicators are related to the immediate activity of Apadrina un Olivo, regarding the recovery of olive trees, activation of production hubs, the experience of adopters and alliances set with other local actors:

The outcome indicators established enable to capture the economic promotion of the primary sector in rural areas, the preservation of the environment and the preservation of the cultural identity:

More business, more impact

In 2020, Apadrina un Olivo was requested to support the recovery of Alacón, a village nearby Oliete. In Alacón there is an extensive production of canned food in olive oil. They had built a facility, with public funds, to enable a company to settle in the village and scale such production, but they never found a company and the facility spent 15 years abandoned.

Apadrina un Olivo saw that the canned food was of high quality and ventured to incorporate it in its business model and to boost the economic activity of Alacón. On the one hand, Apadrina un Olivo was able to scale its impact to a new village. On the other hand, this represented an opportunity to explore a new business stream: the e-commercialisation of canned products through a crowdfarming model. This tool allowed them not only to support farmers to sell their products, but also to make customers aware of their experience and the whole supply chain. To finance this project, Apadrina un Olivo has been able to attract further capital from the “Fondo de Fundaciones de Impacto”, a vehicle set up by Open Value Foundation, Fundación Anesvad and Ship2b Foundation, which gathers 20 Spanish foundations and invests in organisations helping vulnerable communities.

Impact monitoring

The team of Open Value Foundation monitors and supports their investees regularly, making sure they are not overburdened with too many requests. They catch up informally on a quarterly basis, but Apadrina un Olivo is only required to share its impact data once per year.

OVF and the grantees work together on a simple questionnaire, and they adapt it in case the grantees already have other reporting requirements from other investors.

As it is supporting early-stage innovations with patient capital, OVF sees IMM as a means to build evidence and impact expertise. For this reason, even if they set impact targets, the investment is not subject to meeting them. Instead, their function is to trigger a qualitative discussion that enables investor and investee to identify what works and what can be improved.

Aggregating impact and reporting

The main aim of the Theory of Change of Open Value Foundation is to drive investment decisions, but OVF is also able to track its progress towards each output and outcome included in the ToC and aggregate their overall impact across the portfolio.

Every year, OVF also launches a public impact report which is available for all the community.

Learn more

- Apadrina un Olivo

- Mi Olivo

- Open Value Foundation

- Open Value Foundation, Memoria 2020

- Open Value Foundation, Memoria 2021