Impact Measurement and Management Hits a Bullseye

Snowball, a fund of funds, leans on their unique bullseye framework to evaluate impact across their portfolio. Such is the case with a recent investment in the Women in Safe Homes Fund.

Investor for impact

Snowball is one of the few impact funds of funds that exist in Europe. Launched in the UK in 2016 by six family offices and foundations, its mission is clear: to democratise impact investing. The fund was born out of the need for a holistic investment solution to offer scalable impact investing opportunities that wouldn't be available to individual entities working alone. In a short time, Snowball has experienced significant growth, with its initial capital of £12 million on launch to external investors in 2020 scaling to £35 million by the end of 2023.

As a diversified multi-manager impact fund with a seven-year track record, Snowball strategically invests in public and private market funds across six themes that contribute to positive social and environmental impact: energy transition; resource efficiency; regenerative ecosystems; homes and communities; equity and inclusion; and health and wellbeing.

Its unique approach sets it apart in the market; not only does Snowball achieve measurable outcomes and provide consistent long-term returns through their investments, they have also been instrumental in addressing the existing gap in impact-focused investment by acting as a multiplier within the impact ecosystem. Snowball exemplifies this by their ability to influence institutional investors to provide follow-on funding, attracting additional capital to impactful projects and encouraging the growth of the impact ecosystem.

Snowball demonstrates robust internal governance and impact oversight, extending to senior levels. Acknowledging this commitment, B Corp honoured Snowball with the "Best for the World” award in 2021 and 2022, in recognition of the fact the fund ranks in the top 5% of all B Corps globally in the governance category.

Snowball's impact framework

Snowball faces a common challenge in measuring the impact of their holdings: supporting impact funds active in different sectors poses a comparability problem. In response, Snowball created its own assessment framework, which is inspired by established industry standards like the Impact Management Project, Impact Frontiers, and the Operating Principles for Impact Management. The Snowball framework comprises three distinct levels for measuring impact: Snowball's impact, the manager impact and the enterprise impact.

The first layer is at the fund of funds level, and relates to the impact that Snowball has through its relationship with its portfolio fund managers. Snowball directs capital towards solutions that generate positive change and actively collaborates with investees to maximise their impact on their underlying portfolios. Snowball also engages with the sector, sharing learning and collaborating with impact specialists globally.

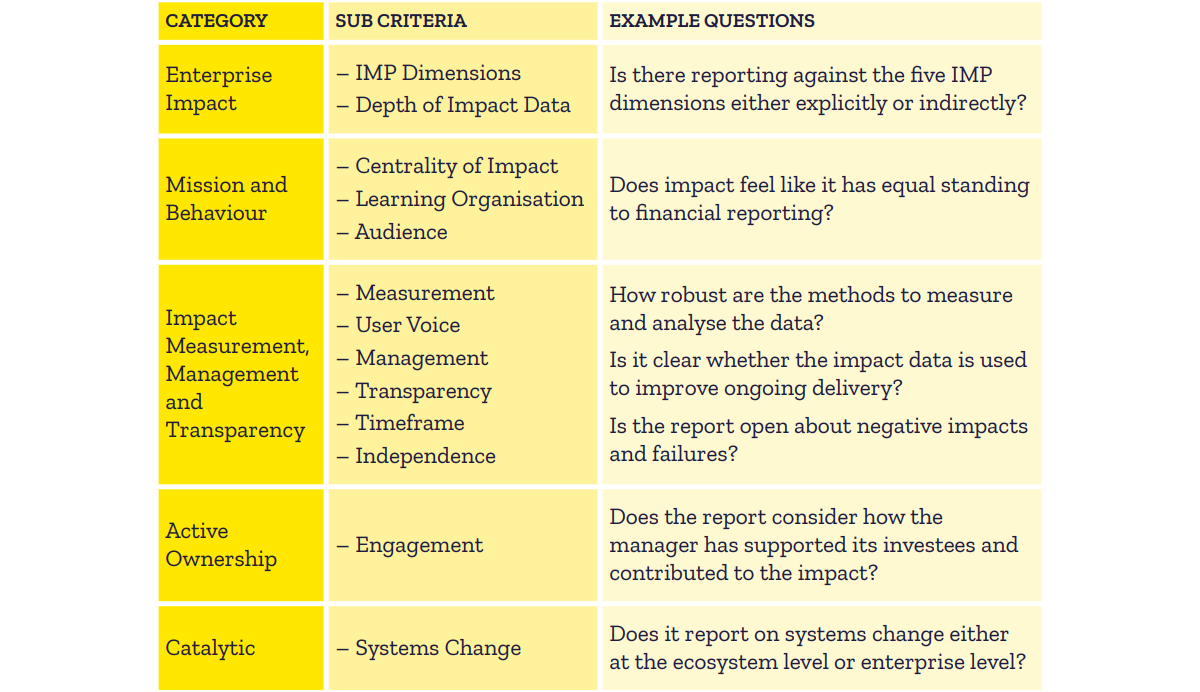

The second layer is at the manager level; this refers to the impact that the fund in which Snowball invests has on the enterprises they support. Snowball assesses whether managers are driven by an impact mission and actively collaborate with their investees to enhance their social and environmental outcomes. To evaluate the impact of each fund manager, Snowball analyses their performance across five categories based on the investor contribution strategies outlined by the Impact Management Project. These include:

- Mission: the extent to which the manager is driven by a mission with impact as its central focus. Examples include whether the manager has the B Corp certification or impact term sheets for each investee.

- Impact process: the manager's impact thesis and their process for assessing and measuring impact, as well as the extent to which they leverage impact data to improve outcomes.

- Active ownership: the manager's level of engagement with investees.

- Catalytic investments: how much the manager contributes to the growth of new markets or wider systems change.

- Impact risk management: the manager’s impact thesis execution and/or how its strategy efficiently channels capital for impact.

Snowball implements the Impact Management Project’s five dimensions of impact framework to assess the enterprise level. These dimensions include the specific outcomes for people and planet that the enterprise contributes towards; the stakeholders involved, including how underserved they are; the extent of impact achieved through the breadth, depth and duration of the outcomes; how much the impact contributes compared to the current state; and the likelihood that the actual impact will deviate from expectations.

Snowball assesses each individual investment made by a manager based on the five dimensions to determine whether the manager is achieving their intended goals and is aligned with their impact thesis.

For the manager and enterprise levels, Snowball uses a set of questions to score the impact of each investment, both during due diligence and on an annual basis post-investment to monitor impact performance. These questions cover aspects like the quality of outcome measurement and reporting, and the fund manager's experience in achieving impactful outcomes.

Snowball's bullseye framework

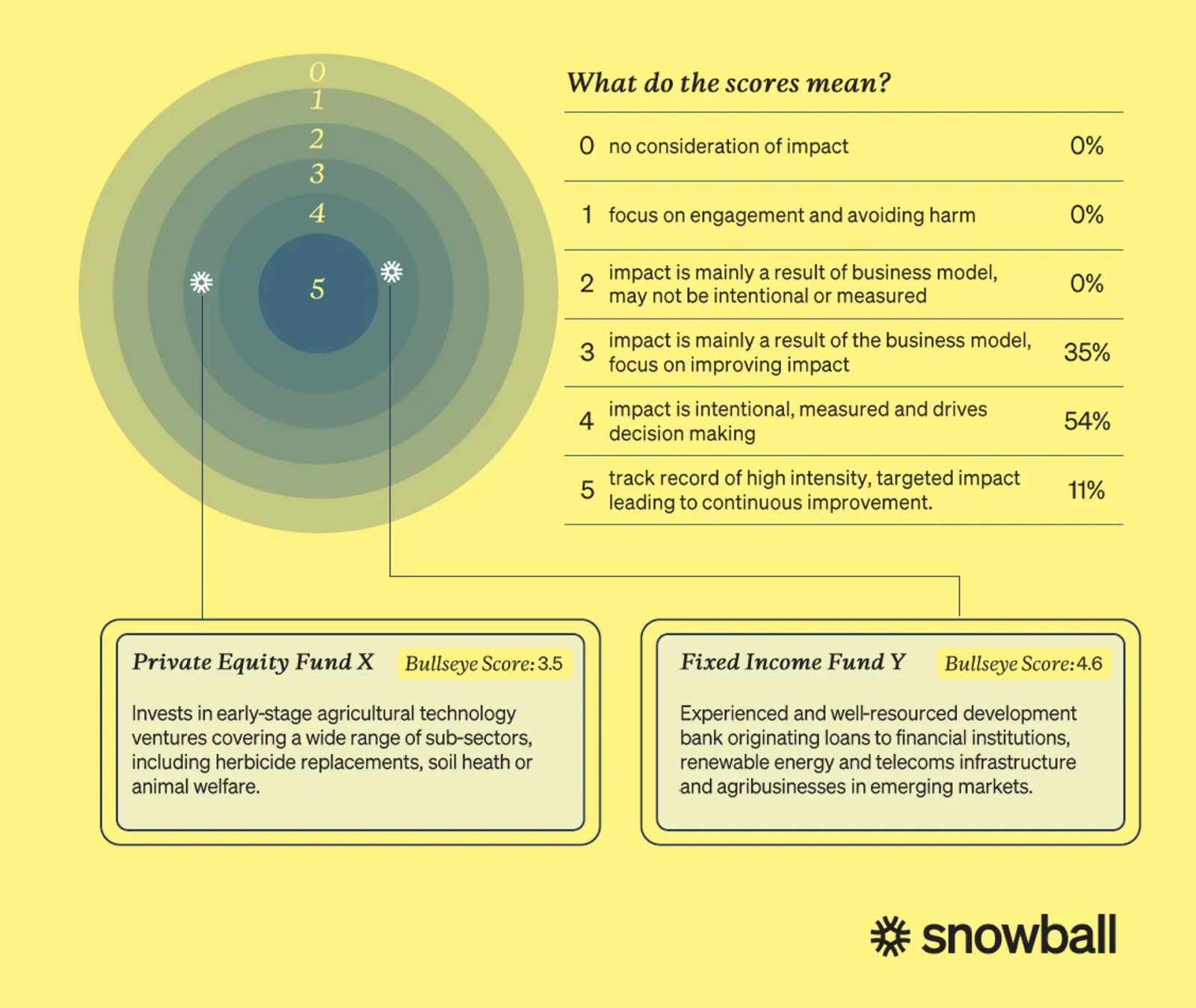

Snowball combines both the manager impact and the enterprise impact score to calculate the impact intensity of their portfolio. This is called the bullseye score and is intentionally designed to set a high bar for fund managers, and Snowball itself, to increase their own impact over time.

- Each investee fund gets a bullseye score, which aggregates the impact of the supported enterprises. The scores are then adjusted based on the ticket size. This way, larger investments have a bigger impact on the overall bullseye score.

- Investments are rated on a scale from 1 to 5. A score of 1 means it's a basic ethical investment that avoids doing harm. A score of 5 means it is a fund manager with a strong history of making high intensity impact leading to improved outcomes.

The Good Economy, a UK social advisory firm specialising in impact measurement and management (IMM)_, conducted an in-depth verification of Snowball's processes and frameworks in 2021, concluding that Snowball’s bullseye score has become a market-leading approach to embedding impact considerations through the investment process. By sharing their in-house methodology, Snowball opened the door for other funds of funds to draw inspiration for addressing challenges in tracking impact within a multi-asset, diversified portfolio. As far as The Good Economy is aware, Snowball is the first asset manager to ever put the detailed findings from an independent impact verification into the public domain – you can read this on their website here. Their efforts were further acknowledged with the "Best Strategy Thought Leadership" award for 'Building an Impact Management Process for a Multi-Asset Class Portfolio' and contributed to their recent win at the Investment Week’s Sustainable Investment Awards for “Best Sustainable Multi-Asset Fund 2023.”

The bullseye score also allows Snowball to select the best managers and optimise their portfolio for impact, risk and return. In Snowball’s current portfolio, 11% of the funds, including Bridges Social Impact Bond Fund, Bridges Social Outcomes Fund II, FMO, Lendable, Real Letting Property Fund I, and National Homelessness Property Fund I, achieve a score of 5. While this percentage may seem small, it mirrors the evolution of these funds over time to attain this score and shows how the bullseye score framework is intentionally designed to set a high bar on how to generate greater impact.

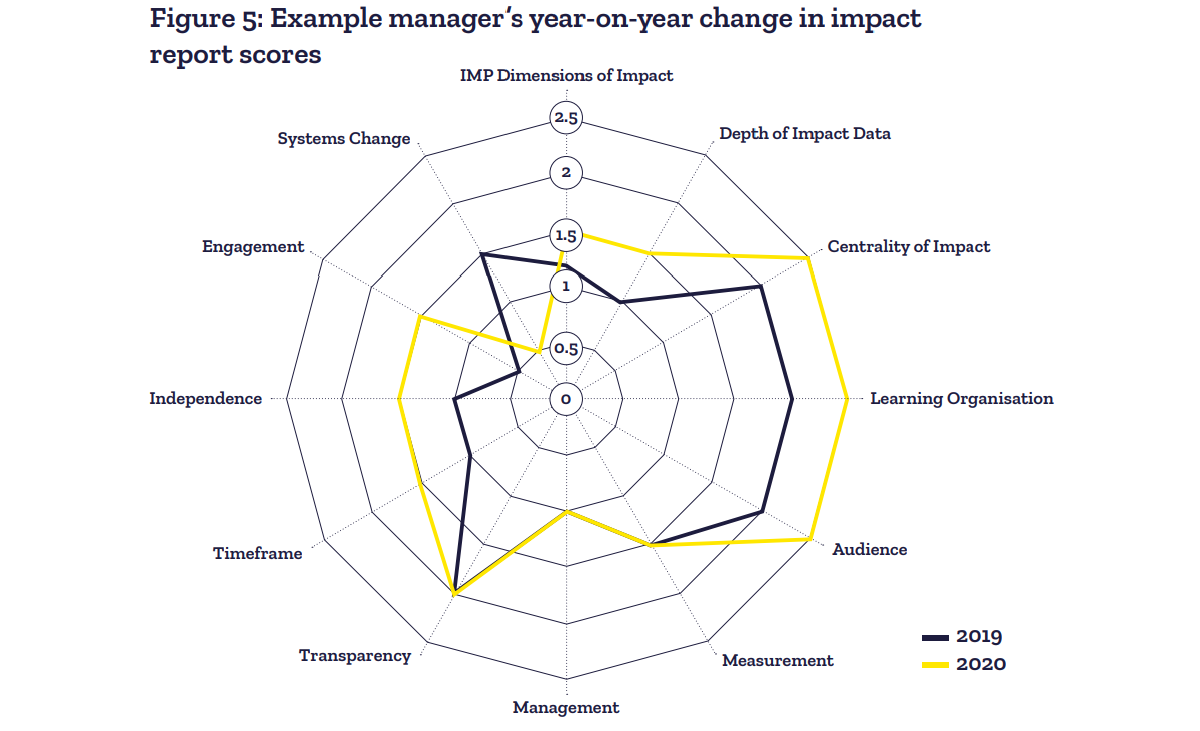

Below is an image exemplifying a fund that underwent bullseye score evaluation and how its score evolved by implementing Snowball's feedback and guidance.

Snowball meets Women In Safe Homes Fund

In the quest to identify impactful projects that can also deliver competitive returns, Snowball sourced the Women in Safe Homes Fund, the first residential property investment fund in the UK with an explicit gender focus. Launched in 2020, the fund is a joint venture of the UK social impact property fund manager Resonance and the European property investor Patron Capital. The fund's primary goal is “helping address the housing crisis for women and children escaping domestic abuse, leaving the criminal justice system and at risk of or experiencing homelessness, or have other complex needs such as mental health problems.”

The fund seeks to fill well-documented gaps: between 2020 and 2021, 1.6 million women experienced domestic abuse in the UK; 60% of individuals living in temporary accommodation were women; 65% of women left prison without safe and sustainable housing; 61.9% of all domestic abuse referrals were rejected due to a lack of space; there was a 22% increase in women seeking support from the national domestic abuse helpline following the pandemic.

Positioned as the world’s first gender-lens property fund, the Women In Safety Homes Fund resonated with Snowball because of its systemic and catalytic approach.

Women In Safe Homes Fund’s catalytic approach

The Women in Safe Homes Fund acquires and refurbishes homes in various communities across the UK. These homes are then leased to housing partners for a decade, providing a stable and supportive environment for women and children. These partners, mostly organisations with a focus on domestic abuse and other forms of violence against women, in turn rent the properties to tenants who are supported by the UK housing benefits government subsidy. Examples of organisations the fund has partnered with include Refuge which specialises in supporting women in vulnerable situations, and Nacro, a national social justice charity that welcomes women recently released from prison and provides support for their next steps in life.

The Fund has also designed a ‘midwife’ arrangement, which allows some charity partners with less experience in property management to be guided through the process – passing on skills and knowledge to help grow capacity in UK women’s organisations.

The Women In Safe Homes Fund collaborates closely with the housing partners, adhering to strict property criteria set by them – such as location (e.g. considering public transport connections and proximity to schools). Each property must be approved and scored by the partner before progressing to the The Women In Safe Homes Fund Investment Committee. Refurbishment specifications are agreed upon in consultation with each housing partner.

This innovative approach, blending leasing and ownership, has the potential to assist thousands of women facing challenging situations to find secure and affordable housing, building capacity and resilience for UK women’s sector organisations. The approach is, notably, catalytic; giving charity partners greater control over the quality and location of properties they operate; providing a capacity-building option for smaller or less experienced organisations – developing their resilience to enable them to support more individuals as a result; and providing permanence in their homes via the lease arrangement. With increased supply and access to affordable housing, women and children in the UK can gain the safety and security they need to achieve economic stability and, ultimately, improve their livelihoods for generations to come.

"Finding accommodation in a refuge was a blessing in disguise. I was in a horrible situation, but I can honestly say that Refuge saved me. The staff here are so supportive and helpful. I received support to find a therapist very quickly, which is not easy during the pandemic. The staff helped me with everything from sorting my benefits and registering with a GP, to supporting me through the daily struggle of rebuilding my life."

Assessing manager impact

As part of the bullseye score framework, Snowball initiated its due diligence by analysing the fund manager's impact. When Snowball assessed the Women In Safe Homes Fund, they quickly understood the potential of the collaboration between the fund’s collaborating entities: Resonance, a social impact property fund manager, and Patron Capital, an established real estate investment company known for its history of previous impact efforts. Snowball saw promise in this partnership; the two organisations not only shared the clear goal to deliver social impact for women and housing provider partners, but could also raise the profile of impact investing for more mainstream investors. Knowledge exchange between Resonance and Patron Capital could pave the way for additional, similar vehicles in the impact investing sector.

Resonance's hands-on approach, impactful thesis and active involvement with investees resonated well with Snowball's criteria. Having launched their first social impact property fund in 2013, Resonance had already provided homes for nearly 3,000 individuals and families across over 1,000 properties, according to their website. While this was the first time they were adding a gender component, a systemic approach and a clear theory of change had always been rooted in their investment thesis. The Women In Safe Homes Fund was no exception: impact was at the centre of the investment strategy.

“The gender-lens approach was key for us: over 50% of our portfolio is invested in social equity solutions, and we wanted to add an explicitly gender-lens fund. They (Resonance) have taken a deeply thoughtful approach to creating a solution which recognises and addresses women’s systemic oppression. Resonance has worked with specialists and people with lived experience of homelessness in creating the fund, and they’ve applied a gender-lens at all levels, including the way they operate it – for example – over 50% of their investment decision makers and advisory boards are women.” Laura Boyle, Head of Stakeholder Engagement, Snowball

Assessing enterprise impact

Snowball applied the Impact Management Project's Five Dimensions of Impact Framework to assess the depth and breadth of impact at the enterprise level.

| What | Enhance safety, health, well-being, and life opportunities by offering support and accommodation. |

| Who | Women experiencing domestic abuse, homelessness, mental illness, ex-offenders, victims of human and sex trafficking, and with children in their care. |

| How much | Impact is tied to fund size and number of properties provided to tenants (Fund size GBP c.30m: 120 properties). The support and accommodation available leads to better outcomes for women and children. |

| Contribution | Addressing the shortage of supply against an increasing demand to access good quality housing for vulnerable women. |

| Risk | Housing partner inexperience, which may lead to execution delays, and vulnerability to housing benefit changes and property market dynamics in specific geographic areas. |

Source: Snowball

The bullseye score and its potential

All the information and analysis conducted during due diligence at the fund manager and investee level enabled Snowball to calculate an initial bullseye score for the Women In Safe Homes Fund. Generally, this scoring process takes place during impact due diligence and undergoes annual updates. The aggregated bullseye scores are used to monitor portfolio-level performance and compare investments and asset classes.

While Snowball does not disclose individual fund manager scores, the Women In Safe Homes Fund obtained a high score, standing out as a pioneering gender-lens fund in the UK with a strong position to deliver deep and lasting impact. Snowball noted the benefits of the lease structure, as it considered both the needs of housing partners and investors: the fund was designed to generate revenue from residents' housing benefits, and would benefit from capital appreciation due to the expected increase in house prices over time. The fund met Snowball’s return requirements and, as its revenues would be government-backed, it would also diversify Snowball's income streams and not be correlated to other investments.

However, Snowball’s bullseye scoring process also identified potential impact risks. For example, some housing partners had little experience in property and tenancy management, which could potentially lead to delays in execution. These were smaller organisations with a background in supporting vulnerable women but lacking a track record in the leasing market. Additionally, the fund was susceptible to the effects of housing benefit changes and potential property market dynamics in specific geographic areas.

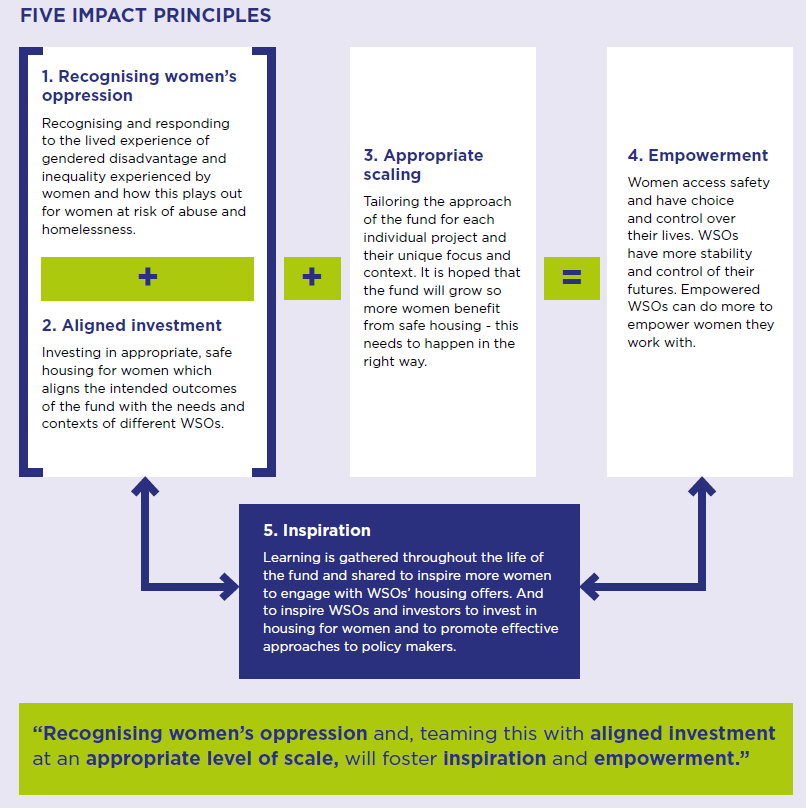

In response to these risks, the Women In Safe Homes Fund committed to leveraging their experience to actively support these housing partners in enhancing their expertise in property management, including via the “midwife” mechanism, expanding their portfolio of properties and strengthening their financial positions. The fund focused its risk-mitigation strategy on two impact areas crucial for housing partners: impact aligned investment and appropriate scaling. The strategy is customised to the specific circumstances of each housing partner, investing in housing suitable for the organisation's needs and fostering a growth model that supports financial and capacity development for each housing partner.

After assessing the Women In Safe Homes Fund’s commitments and strategy, Snowball determined that the potential impact significantly outweighed the identified risks, leading to the decision to move forward and invest in the fund.

Deal overview

For its launch, the Women In Safe Homes Fund secured funding from four seed investors: Big Society Capital, MacArthur Foundation, Keith Breslauer (Patron Capital managing partner), and Lostand Foundation, achieving its first close at £15.5 million in December 2020.

Snowball is one of the 20 investors that contributed with equity in subsequent rounds, allowing the fund to reach approximately £30 million. Snowball's financial contribution was also catalytic, as it was one of the first institutional investors in the fund before it reached scale.

The shared ambition among funders and fund: to purchase 120 homes and to house and support 350 women and their children.

While Snowball typically adopts a hands-on approach with fund managers on impact management practices, especially with first-time managers, this was not required in this particular deal due to Resonance's established impact track record and mission-first approach.

Tracking impact performance

Snowball uses their bullseye framework beyond the screening and due-diligence phases to track impact performance. The framework acts as a comprehensive impact rating system. Notably, impact metrics and targets are not monitored at the portfolio level, emphasising the central role of the bullseye score in evaluating and managing the overall impact of the investments.

In 2020, when the Women In Safe Homes Fund was launched, Snowball understood it would take time to see its impact, especially since the first tenants were expected to move in during Autumn 2021. However, the fund’s long-term vision was clear: to address the chronic shortage of safe, decent and affordable housing for women at risk of and experiencing homelessness by acquiring suitable accommodation - working closely with housing partners to provide women and their children with a safe and stable home as well as specialised, wraparound support enabling them to overcome trauma and to become empowered to start creating lives of their choosing. With a fund size of £20 million, nine properties already acquired and seven housing partners on board, WISH aimed to acquire 650+ properties, with an envisioned target fund size ranging from 100 million to 200 million, according to WISH’s 202o-21 impact report. The ultimate objective was to provide housing for 6,000 women throughout the fund's lifespan.

Between 2020 and 2021, the Women In Safe Homes Fund worked on establishing a comprehensive measurement framework, working alongside housing partners to identify five impact principles and track outcomes for women, showcased in the visual below.

They also developed a set of impact measures aligned with the five principles to generate impact at three levels: women accessing housing, housing partners and the wider system.

Examples of Key Performance Indicators (KPIs) for women accessing housing include metrics such as the number of women housed and the percentage of women who perceive their homes as safe. For housing and partners, KPIs encompass metrics like the number of charity partners, the percentage of organisations led by underrepresented communities and the extent to which the housing portfolio meets the range of women's housing needs. At the systemic level, KPIs assess the value for money and/or cost savings of the model.

In addition to quantitative data, qualitative insights have been captured through interviews and a learning workshop with housing partners.

As of December 2023, the Women In Safe Homes Fund expanded its portfolio to include 63 properties, with 40 of them handed over to housing partners. Notably, this marked the first year where quantitative data began to be reported, shedding light on key aspects such as the composition of households, reasons prompting tenants to seek accommodation, and the positive steps women took towards employment or job security. The fund started demonstrating tangible positive outcomes, as evidenced by the successful housing of 206 women and children. Furthermore, 91% of women reported a positive impact on their wellbeing and life outcomes, 87% felt safe in their homes, and 83% noted an improvement in mental health since residing in their homes. These statistics, provided in the Women In Safe Homes Fund’s 2022-23 impact report, affirm the fund's progress in achieving its goals.

Snowball leveraged this quantitative data for evaluating the potential magnitude of positive impact the fund could achieve. The impact scale is still closely linked to both the fund size and the number of properties offered to tenants.

The nature of the bullseye score highlights the importance of having comprehensive data for a thorough portfolio performance assessment. As quantitative data was limited during the first two years of the fund, Snowball opted for a patient approach, deferring the assessment of the Women In Safe Homes Fund's actual impact until more data was available, instead basing its assessment on the expected outcomes. Throughout 2022 and 2023, as property acquisitions were underway, Snowball continuously monitored the fund's performance and its deployment.

As data gradually becomes more accessible over time, Snowball is now doing regular annual reviews of WISH's bullseye score, aligning with their established practice for assessing the impact across their entire investment portfolio.

Scoring impact reports

As reported by Good Economy in its analysis of Snowball, “it is one of a very small number of investors that employ a highly focused engagement approach, aiding in the development of the manager's impact processes and practices.” In practice, this means Snowball evaluates and scores the impact reports from fund managers in their portfolio and helps them improve their impact practices.

Snowball actively engages with its investees in impact measurement and management through four areas, which are as follows.

- Impact Practice - how impact is integrated in decision-making, improving communication of impact, defining criteria for individual investments, Key Performance Indicators (KPIs), and enhancing impact reporting.

- Impact Reporting – reviewing and providing feedback on fund managers’ impact reporting.

- Diversity, equity and inclusion (DEI) in the fund and respective investments.

- Environmental Sustainability - Net Zero and Nature Positive – engaging on the manager’s climate and biodiversity engagement strategies.

Scoring impact reports is a critical activity for Snowball to offer comprehensive feedback to its managers. Upon receiving an annual report from the fund manager, Snowball evaluates it based on a series of questions that are tailored to the manager and enterprise frameworks, as illustrated below.

These questions set aspects of management performance that Snowball wants to see improved over time. The scoring of impact reports also helps review the integration of end-user voice and experiences by the funds they support.

While Snowball’s evaluation of the Women In Safe Homes Fund’s impact processes and practices is still evolving – pending updated impact outcomes information from the manager, Snowball can review the fund’s engagement on net zero. The Women In Safe Homes Fund is committed to assessing the Energy Performance Certificate (EPC) ratings of properties, recognising that around 21% of the UK's total carbon emissions stem from homes, in alignment with the UK Government's goal to raise the energy performance standards for properties in the domestic private rented sector to attain an EPC rating of C.

Ecosystem benefits

Snowball has shared their insights on the Women In Safe Homes Fund case, even at this relatively early stage, because transparency and accountability are key values for them. Snowball shares the average bullseye score of its portfolio in its quarterly investor reporting, based on the individual manager impact scores. It also openly shares its impact methodology - including learning, and improvement areas - in the hope that this can be adopted by other stakeholders. Snowball also shares impact activities and engagement through a regular blog.

Lastly, Snowball underwent independent verification of their impact practices by The Good Economy in March 2022, using the Impact Assured methodology. This external scrutiny showcased Snowball's innovative impact management strategy and its attention to detail in reviewing and scoring impact reports, as well as areas for improvement. Examples include improving the assessment of stakeholder voices providing a clearer articulation of the assumptions behind their theory of change.

By making the revision public, Snowball demonstrated transparency and a commitment to being held accountable, setting a benchmark in the industry for openness about impact practices.

In their mission to change behaviours in capital markets to ensure all capital is invested for social and environmental impact together with market rate financial returns, Snowball has been actively contributing to growing the impact investing ecosystem. They have engaged in industry initiatives and policy activities, shared best practices, and participated in research projects, webinars and panels. Examples of this include:

- Snowball’s collaboration with other multi-asset class investors through the peer learning and market building network known as Impact Frontiers, aimed at exploring strategies to build a portfolio of investments that optimizes overall impact while considering expected risk-adjusted financial returns.

- Snowball co-hosted a webinar series “Strengthening transparency and accountability in investment’’ with The Good Economy convening impact practice specialists globally including from Blue Mark, The Rockefeller Foundation, WHEB and Impact Frontiers

Impact moves forward

Snowball's bullseye score, applied in a multi-asset portfolio, is a clear and innovative example of how relevant IMM can be used to improve managers’ performance and amplify their impact. This is the same dynamic and engagement Snowball expects to have with the Women In Safe Homes Fund.

Among the 20 investors in the Women In Safe Homes Fund, Snowball stands out as an impact guardian, centering the fund’s conversation around their impact mission and seeking to help them improve their impact practices and processes to amplify their impact.

The Women In Safe Homes Fund accomplished the majority of its operational and setup milestones within the initial three years. The fund is now directing its attention towards three critical areas for sustained impact and growth: women and children, partners and systems. The fund aims to refine its impact measurement methodology for a more comprehensive understanding of the needs of women and children seeking tenancy. Additionally, it aims to strengthen partnerships with housing stakeholders to ensure effective collaboration and shift its focus to impact research, investigating barriers in the broader ecosystem hindering the safe housing of women. Snowball is poised to offer support in these next stages for the Women In Safe Homes Fund.

The full impact of the fund is still unfolding, but early signs suggest valuable benefits and learnings for Snowball. As the fund progresses, Snowball will continue to actively monitor, adapt strategies and collaborate with the Women In Safe Homes Fund, demonstrating their commitment to fostering positive outcomes and further solidifying their role as impactful investors in the sector.

If you are interested to read more about the Snowball impact methodology, click here, and to read the findings from the independent verification of their impact processes, click here. If you’d like to discuss impact investing with the Snowball team, please email hello(at)snowball.im

Partners: