How investors for impact assess contribution and attribution

Striving to achieve a positive change for society is at the heart of what investors for impact do. They therefore need to understand how and to what extent they contribute to solving a social issue.

How do investors for impact measure their contribution? How do they assess how much of the change achieved is the result of their activities? Is the solution they invest in addressing the root causes of a problem?

Our second edition of the Burning Topics series on Impact Measurement and Management provides some answers, with insights on investor contribution and attribution from experts in the field

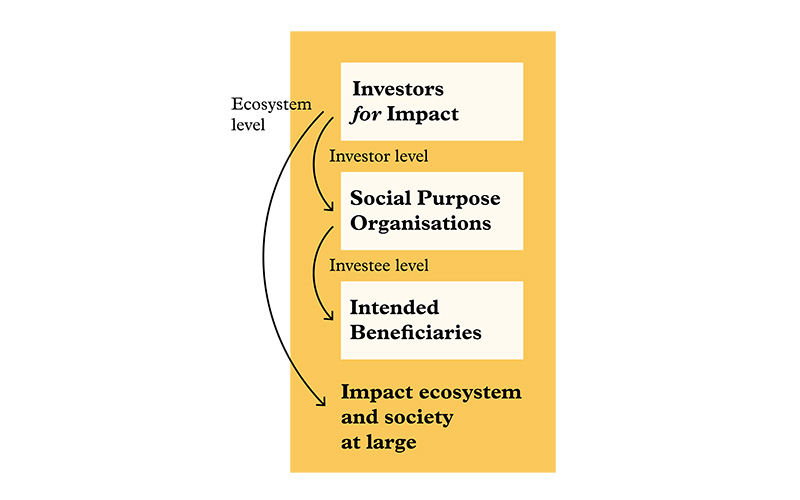

Investors for impact need to know how they are achieving impact at three main levels:

- How their investees’ activities ensure positive change for people and the planet (investee level)

- How their own contribution strengthens the capacity of organisations supported (investor level)

- How they contribute to developing the impact space at large and systemic change (ecosystem level)

Investors for impact can measure their contribution by basing the added value they bring to their investees/grantees. This includes the assessment of the following outcomes linked to the organisations supported: (i) increasing their financial solidity, (ii) developing and/or refining their impact management practices, (iii) improving their organisational resilience, (iv) strengthening underserved organisations and (v) playing a catalytic role.

How are investors for impact using their support to improve their investees’ impact?

The financial, and especially non-financial, support investors provide to their investees is essential to:

- enhance their financial solidity so that they can strengthen their business model and diversify their income streams;

- develop their impact management practices so that they can achieve more impact; and

- increase their organisational resilience, so that they can improve their governance systems and staff expertise.

Sometimes, investors for impact take high impact and financial risks to strengthen underserved organisations, which would not have been funded by other investors, as they are usually in early stages of development with disproportionate risk/return ratios. As this allows investees to grow and become less ‘risky’ for more mainstream investors, investors for impact can also play a catalytic role by helping them attract additional capital from other investors.

Why is it important to assess whether the impact is our making?

To gain a more comprehensive picture of their contribution, investors for impact also assess attribution, i.e. how much of the change observed is the result of their activities.

In order to do this, they must find out how other actors work to address the same societal problem. Comparing and benchmarking oneself against these actors can help develop synergies and strategic alliances, and therefore avoid working in silos and duplicating costs.

By assessing attribution, we can understand not only what changed, but also how investors and investees contributed to the change, compared with other contextual factors and organisations. Investors can find out whether the solution is addressing the root causes of the problem – if it is, it will have a higher chance of success

*

How We Assess Contribution – Nicole Feliciani, Erste Social Banking

Since 2017, Nicole Feliciani works for Erste Group in the Social Banking Development. She is responsible of the impact assessment and management of the Erste Social Banking financial and non-financial activities in Central and Eastern Europe.

We caught up with her about how this organisation assesses its contribution in practice, and some of the lessons learned.

As an investor for impact, at Erste Social Banking we have been assessing our impact since 2016. By doing this, we aim to understand if and how our financial and non-financial support is enhancing the economic and social performance of our investees and consequently fostering financial stability in central and eastern Europe. It also enables us to improve the programmes we are running and to better plan the next investment strategy.

The assessment of our contribution focuses on three main outcomes: creation and preservation of jobs, growth in the social impact of our investees and improvement of their financial stability. To measure these outcomes, we conduct phone interviews with a sample of our investees who have started the investment journey with Erste Social Banking since at least six months. We have developed different questionnaires for our investees, based on the type of support we provide and the specific outcome we would like to measure. The data is anonymised then aggregated, analysed and published in a final report.

Over the years we have learnt that the process of assessing impact needs to be as simple as possible and based on a clear definition of the outcomes. Questions to the investees need to be easy to understand and answer by phone, i.e. investees do not have to know or collect many data for the interview. For this reason, we have significantly simplified the questionnaires and reduced the time our investees need to spend on the phone. It is also important to leave some time for comments and give the investees the chance to freely express themselves during the interviews. A final lesson learnt is that assessing impact works as an energy booster both for us as investor and for our investees: good outcomes motivate us to do more while areas for improvement push us to do better.

*

Assessing attribution, investor contribution and additionality – Lara Viada, Creas

As Partner at Creas, Spain’s pioneering impact fund, Lara Viada brings deep expertise and passion to her work in Social Entrepreneurship and Impact Investing. Her work actively supports the development of these sectors in Spain and globally, having worked for impact funds such as the US Development Finance Corporation in DC and Grassroots Business Fund in Latin America.

Lara Viada gives some insights into how Creas finds a balance between investing in companies that are ready to scale quickly versus those pursuing long-term goals in systems change.

Value Creation

Impact investing has evolved at an incredible pace since it started 15 years ago. Many institutional investors have understood its importance and taken responsibility to direct capital towards fighting climate change and reducing growing inequalities, amongst others. As impact becomes more mainstream, it becomes particularly important for pioneer impact funds such as Creas to keep raising the bar and ensure that the impact investing industry maintains the highest standards – both in sourcing and selecting truly transformative ventures but also in how investor’s contribution support takes place, so that impact is maximised.

At Creas we truly believe in the importance of actively supporting the companies we invest in, and we do so by putting impact at the core of our value proposition for LPs and entrepreneurs. We do so with the belief that social and environmental impact is a lever for sustained value creation.

We mobilise the power of our network of experts and advisors and focus our support around three main axes:

- Strategy: We support companies to be in constant communication with their beneficiaries to review and align strategy and operations with impact. We support companies with growth (to foster product/market/impact fit), supply chain/operations (to maximise impact potential and improve performance), governance (to adapt to the best standards) and communication (to enhance the company’s market positioning).

- People: We support teams to achieve their best potential by attracting, developing and aligning talent with the company’s purpose and business/impact plan. We also put a lot of emphasis on integrating impact into incentive plans (to align profitability and impact).

- Capital: We bring in investors who share the company’s mission, both at local and international level.

Investor Contribution for creating systemic change

When investors put impact at the heart of their strategy as we do at Creas, they often have to deal with trade-offs between supporting the most impactful ventures or choosing those that will scale more quickly. As with technology disruptions, some societal transformations are more mature and market-ready than others. Today companies tackling environmental challenges are developing quickly, with governments, consumers and companies increasingly aware of the importance of transforming our consumption models. Companies supporting circular economy models, energy transition or sustainable mobility have seen an incredible growth during the last years and will continue to do so.

Conversely, companies working to achieve systemic change and proposing innovative solutions to inequality, lack of inclusion, or healthcare issues are slower to scale, precisely because they are working to solve difficult and structural social problems. These companies require patient capital and the support of investors who prioritise social impact and long-term transformation over high short-term financial returns.

At Creas we strive to find the right balance between these two “opposites” by building a diverse portfolio of high-growth market-ready and patient capital investments. We use the Impact Management Project framework to categorise and communicate our role and impact as an ecosystem creator in Spain. We invest only in companies Contributing to Solutions (C). Around 30% of our investments are in impact ventures who have already reached a certain market maturity and whose solutions are highly scalable (C2). Here our role is to encourage them to put in place a comprehensive impact measurement and management system. Most of our investments (around 60%) go a step further and are in sectors and companies where other investors only focusing on financial returns are not focusing, and where we are growing new or undersupplied capital markets (C4). The rest of our investments (10%-20%) are in companies focusing on deep systemic change that require additional flexibility in the risk-return-impact profile to really achieve their impact potential (C6). These are therefore the investments where we have the highest level of impact contribution.

*

Identifying the Root Cause to Come up with a Better Solution – Anne Holm Rannaleet, IKARE

Anne Holm Rannaleet from IKARE gives some examples of how IKARE strives to understand and address the root causes of a social issue to have a more effective impact.

If we reflect on what could be the most obvious solution to ensuring no child dies or suffers from preventable diseases in developing countries, the first answer that comes to mind might be developing and distributing more vaccines. Yet despite the vast amounts of resources spent by governments on monitoring and evaluation of health data, many children never become fully immunised. In addition, huge numbers of vaccines go to waste in developing countries, because the best before date is too short when they receive them, the cold chain is broken, or they are simply in the wrong place when needed.

If we take the time to understand why this happens, we realise that the current paper-based systems to track and follow-up not only the vaccination process of each individual, but also primary health care service delivery in general, is costly and inefficient. Poor data accuracy also hinders proper information on vaccine distribution at each health centre as well as on a national level. This is where our partner Shifo Foundation came in, with their Smart Paper Technology (SPT) which has enabled 99% data accuracy and a 60% reduction in time spent by health workers on paperwork, even if health centres lack electricity and ICT infrastructures. Thanks to the SPT system, KPIs can be set and monitored at individual patient, health centre, district and national level and followed up monthly, enabling a timely and full immunisation of children. The system is currently implemented in six developing countries, for different parts of the health and logistics data management systems, and with two additional countries in the starting blocks. One million patients have already been registered with their unique IDs.

Here is therefore our first learning: finding and addressing the root cause of a societal challenge is typically cheaper and more effective in the longer run than just addressing the symptoms (over and over again).

But there’s more.

The Stamp Out Sleeping Sickness (SOS) Initiative, which we joined in 2006 together with the pharmaceutical company Ceva, the University of Edinburgh and the Makerere University in Uganda, responded to an emergency situation in Northern Uganda: stopping the rapid spread and risk of convergence of two strains of sleeping sickness transmitted by tse-tse flies in the region. In addition to human suffering, it causes an estimated three million cattle deaths every year and widespread chronic ill-health, spontaneous abortions and reduced productivity of cattle herds.

Until then, cows were typically protected from being infected with sleeping sickness through use of so called dipping tanks. Farmers would need to bring their cattle, often over long distances, to such tanks and let them walk through, immersing their bodies in the insecticide. Alternatively, a bottle of insecticide would be poured over the cow. While considerably cheaper than having to construct and maintain dipping tanks full of insecticide, the cost of the pour-on insecticide was still around 12 USD per cow per year. Thanks to the introduction of the Restricted Application Protocol methodology, through which cows would only be sprayed on the body areas targeted by tse-tse flies (legs and belly), the cost was reduced to 72 cents per cow per year. In addition, this spraying could be done directly at the farm.

But cost wasn’t the only problem. Farmers were not treating the animals because they simply did not have access neither to the necessary knowledge nor the right products, and vets in the area were few and far apart. A whole infrastructure was missing, and this is why we developed the 3 V Vets initiative, to ensure an effective and lasting solution to the issue, and improve animal health and livelihoods in the area.

Understanding these structural issues allows us to target the interventions so as to eradicate or at least control the problem itself.

Root causes of social problems are often complex and thus not always obvious, and it is natural to start by addressing the symptoms. But asking stakeholders about their concerns with the current solutions and engaging with the communities allows us and our partners to peel the onion and understand why some solutions do not work, what alliances need to be developed, and how to make the most of an intervention.

Building the better solution is a trial and error journey, a constant learning process that entails accepting that you don’t have all the answers from the beginning, and that you have to adapt as you evolve. It ultimately demands flexibility, time and collaboration. But assessing if and how much the proposed new solutions contribute to achieving systemic change is fundamental to come up with a better, but still affordable, solution and ensure real impact on people and the planet.

*

This post first appeared as a LinkedIn article.