Ensuring accountability through stakeholder engagement

Investors for impact have always put accountability towards their stakeholders – funders, investees, beneficiaries, and society at large – at the heart of their work.

How do investors for impact hold themselves accountable? How do they lead by example? What challenges do they face when engaging with stakeholders whose interests and views vary?

These are questions that keep investors for impact up at night. And they’re the subject of the first instalment in our Burning Topics series on Impact Measurement and Management.

Throughout the Burning Topics series, we’ll share practical insights directly from leaders in the field of impact measurement and management.

But first, let’s put accountability in context.

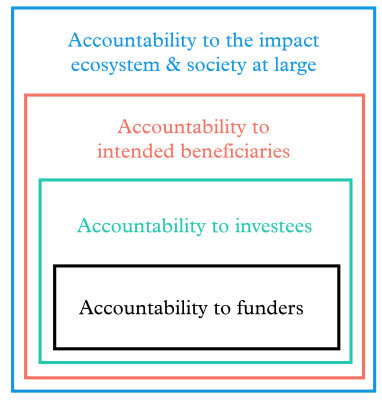

Stakeholder accountability is fundamental to change the narrative around investment, as lack of accountability in the financial sector has contributed to negative social and environmental impacts for decades – and still does. In practice, investors for impact strive to be accountable to their funders (including taxpayers if the investor is a public institution or is funded by one), investees, intended beneficiaries, and the impact ecosystem and society at large.

How do investors for impact hold themselves accountable to their stakeholders?

Engaging with stakeholders is the first step, but accountability goes far beyond this. Accountability also means: being transparent about investment decisions; building trust-based relationships; co-developing solutions; collecting meaningful feedback and, most importantly, putting it to use in the decision making process.

*

Data-Driven Accountability – Interview with Jeremy Nicholls, Founder of Social Value UK

We interviewed a seasoned expert on impact management and measurement – Jeremy Nicholls – to hear his views on what it means to be accountable and how it helps to measure real impact.

Jeremy Nicholls has served as Chief Executive of Social Value UK and Social Value International. As early as 2007 he founded the SROI network to change the way the world accounts for value. He is the co-author of the book There Is No Business Like Social Business, and currently holds the position of Assurance Framework Lead for SDG Impact Standards at UNDP.

“If people experiencing impact had the power and investors were held accountable, organisations would have no choice but to ramp up the frequency and scale of impact-led decisions based on data”

-Jeremy Nicholls

Why do investors need to be held accountable?

If people experiencing impact had the power and investors were held accountable, organisations would have no choice but to ramp up the frequency and scale of impact-led decisions based on data and to understand the risk of making suboptimal decisions. That would be a big change.

The metrics we should be interested in to track progress would report on the changes we have made, informed by the impact data collected. It is more important for an organisation to be making decisions between options with imperfect data than to be making no decisions with a perfect impact report.

What information do we need to ensure the voice of stakeholders is heard?

If we are acting in the interest of those people without asking them, let’s assume that they want the greatest possible positive impact, and the sooner the better. The information is a test of how far we have gone to meet that, how relentlessly we are making comparisons to find ways of improving. In the end, how much power we have shifted.

One of the problems related to impact is that people can say: “I have moved my impact from 1 to 2, and that is a success”. However, if the minimum impact you need to achieve to reach the SDGs is 6, then the fact that you moved from 1 to 2 is not a success at all, it is a failure.

How can impact assurance guarantee accountability?

There are no guarantees but it astounds me that we, as a society, are auditing financial reports to protect shareholders but we are unwilling to do that for organisations’ impact statements, to protect the people experiencing the impact. Financial assurance is not just assurance that there is a profit not a loss, it’s also assurance of the level of performance being reported. Equally impact assurance should not just be about whether there was a positive impact but should allow comparisons of performance in creating that impact. Impact reports without assurance are marketing reports.

Why is Impact Measurement and Management still driven by rigorous measurement from the funder’s perspective rather than from performance in decision-making?

The approach of Impact Measurement and Management has been driven by asset owners, who wanted to check whether or not they were having an impact. That guided them towards evaluators and a focus on ‘rigorous’ data. This approach led us to see impact data as a test of impact rather than a source of insights, and then against a predetermined level of rigour rather than one good enough to avoid make suboptimal decisions.

"Impact reports without assurance are marketing reports."

-Jeremy Nicholls

*

Balancing Multiple Layers of Accountability – Peter Beez, Swiss Agency for Development and Cooperation

Being accountable to different groups of stakeholders means that investors need to tackle potential trade-offs. For example, too much focus on designing a process to share information with funders, which is just one of the relevant groups, might reduce the capacity (and the time) to understand the perspective of other stakeholders.

Peter Beez is a Program Manager and Regional Thematic Advisor for the Swiss Agency for Development and Cooperation. His work for this organisation aims to drive inclusive economic development through innovative and impact-linked finance.

Here he gives some insights into the challenges of being accountable, as a public institution, to a broad range of stakeholders and the choices they have to make:

As the Swiss Agency for Development and Cooperation (SDC) is part of the Swiss Government, it is ultimately accountable to tax payers and voters. Swiss development cooperation aims to contribute to achieving the SDGs in those geographic areas and topics where Switzerland and SDC focus. In practice, objectives are provided by parliament, government, head of department, SDC management, direct superiors, etc.

We therefore have to be accountable to different stakeholders in each layer of power. Adding to this complexity, SDC should also be accountable to the final beneficiaries (or their representatives) and to other development partners (private sector, implementers, other donors, etc.).

We use many different reporting tools and formats to ensure this accountability. We have the standard operational and financial reports, reviews, external evaluations, financial audits, as well as annual reports for country, unit, and thematic programmes. But we also use more innovative formats to convey our impact, such as podcasts, videos, social media, press releases, conferences, websites.

In practice, maintaining accountability towards a broad range of stakeholders is challenging for the following reasons:

Aggregation: SDC would like to present “global” or portfolio achievements to be accountable to certain stakeholders that would need aggregated figures (e.g. government, tax payers). But these figures are challenging to produce. One recent effort has been the introduction of so-called aggregated reference indicators (ARIs) to measure the impact of investments and allow aggregation across the portfolio. However, the context is extremely important: for example, whether the project is in a rural or urban area, low-income or middle-income country, etc. These differences hinder aggregation.

Quantitative and qualitative: SDC tries to use financial and economic analysis (ex-ante and ex-post) of our interventions whenever this is possible (with reasonable effort). This is a key instrument for investors to make sure that we are not only maximising financial return, but also social return. Obviously, it is not that easy to put numbers on good governance, the value of a system change, less inequality, etc.

Reasonable effort: As usual, the 80:20 pareto principle should apply. We have to accept that we cannot measure, control and account for everything. This would be too resource intensive, in a context where scarce resources are needed to achieve more results.

Cost: New technologies can help drive measurement costs down. However, many reasons impede the swift introduction of these technologies (e.g. lack of knowledge, financial interests, etc.).

*

Power to the Grantees – Céline Yvon, Trafigura Foundation

The inherent power imbalance in investor-investee relationships can also hinder honest and constructive feedback. Investors for impact can restore balance by cultivating relationships with their investees – and, by extent, the beneficiaries – even if the investee relies heavily on the investor’s financial support to grow or maintain its operations.

Céline Yvon, Deputy Director of the Trafigura Foundation, brings 20 years of experience across the full spectrum of social change, venture philanthropy and international cooperation. She oversees a global portfolio of partnerships geared towards improving the living conditions of vulnerable communities.

Here she explains how investors listen to their grantees and ensure healthy relationships with them:

Relationships are inevitably distorted in favour of those who hold power. No matter how committed we may be, as donors, to foster transparency, respect and learning in our work ethics and partnerships, we cannot ignore the risk that our grantees – dependent as they are on our support – may not feel comfortable enough to provide us with their genuine feedback.

Without our partners’ candid inputs – particularly when these point at possible weaknesses or shortcomings in our donor practice – our work may not deliver its full potential for impact. It may also increase the risk of us inadvertently having a negative effect on communities we serve or on organisations we work with. Some of our reporting requirements, for example, may inadvertently strain our partners’ already limited resources and have a counterproductive effect on their ability to deliver actual impact.

To overcome the potential blind spots that come with power imbalances, the Trafigura Foundation commissioned a professional third-party organisation, the Center for Effective Philanthropy, to conduct an anonymous Grantee Perception Survey. The Survey covered multiple topics related to our partnership lifecycle (i.e. from how we select our grantees to our reporting and evaluation requirements), the Foundation’s role and impact, and its relationship with grantees. This collaborative exercise has helped us capture the strengths of the Trafigura Foundation, identify opportunities for improvement as well as formulate key questions for the future. The buy-in of the Foundation’s stakeholders and staff and their commitment to genuinely address the findings, whatever they may be, was one of the factors that contributed to making this a successful experience; as well as the fact that our partners actually made use of this opportunity to help us grow – a stunning 83% of them participated in the Survey.

This being said, a Grantee Perception Survey is only an occasional instrument that helps us donors strengthen our understanding of our actions, and how these actions may be perceived. Putting accountability at the heart of our practice implies much more in terms of priorities, allocation of resources and work culture. For example: developing a vision of our role, added value and criteria for engagement – and communicating about it in a transparent manner; clarifying the types of support that we may or may not be able to provide – and stand ready to be challenged on that; formulating expectations towards partners in an explicit manner – and ensuring that they have the resources to understand and deliver; sharing our experiences, good and bad, and investing actual resources so that our learnings benefit others; seeking proactive and open-ended conversations with grantees and actively inviting them to challenge our models and beliefs; etc. Such efforts foster strong relationships with partners and are prerequisites for an effective, meaningful and legitimate action.

"How would I define accountability in a nutshell? Acting upon the understanding that the privilege of giving comes with responsibilities."

-Céline Yvon

*

Through the Beneficiaries’ Lens – Perspectives from Tom Kagerer and Smiti Sahoo, LGT Venture Philanthropy

Investors encourage their investees to do the same towards the intended beneficiaries who are, in turn, dependent on the investee. Addressing this power imbalance is essential to measure and manage impact, as it enables investors to collect valuable, honest and meaningful feedback from each type of stakeholder.

We asked a few questions to Tom Kagerer and Smiti Sahoo from LGT Venture Philanthropy to find out how they do this.

As Partner at LGT Venture Philanthropy Foundation, Tom Kagerer deploys philanthropic capital to organisations with effective, innovative and scalable solutions to social and environmental challenges. In past roles at LGT VP, he coordinated impact evaluation activities, and social performance data management and reporting.

Smiti Sahoo is an Investment Manager at LGT VP. She has worked to co-develop LGT VP’s investment and IMM strategy and managed portfolios for education, healthcare and environment themes in India.

How can a foundation be accountable to final beneficiaries even if there is no direct link with them?

LGT Venture Philanthropy works closely with organisations rooted in local communities. This means the very core of our mission and work is the impact these organisations have on the intended beneficiaries. We measure the reach and depth of that impact by using tools and frameworks based on industry best practice standards. We apply a hands-on approach by conducting extensive field visits to engage directly with beneficiaries and get their perspective on how the services provided to them improve their lives and livelihoods. We have piloted lean data assessments which allow the organisations we support to receive direct feedback and generate actionable insights from beneficiaries. This enables us to hold both ourselves and the organisations we support accountable for generating tangible and lasting social and environmental impact.

What questions do you ask to assess whether your potential grantees take the views of beneficiaries into account to develop their services/products?

We conduct extensive due diligence to understand the potential grantee’s theory of change – from the activities it undertakes to the outputs, outcomes and long-term impact it aims to achieve. We apply global best practices, such as the framework created by the Impact Management Project (IMP), which examines five dimensions of impact performance (What, Who, How Much, Contribution, Risk). We also analyse how the organisations we support engage with the beneficiaries, how they get feedback from them and the safeguards they put in place to protect their interests.

How do you ensure feedback from beneficiaries is taken into account to refine the activities of your grantees?

Post investment, we track our organisations’ impact on a quarterly basis, by monitoring KPIs that measure social and environmental outputs and outcomes.

This helps us assess whether we need to work more closely with the organisation to bridge gaps in impact measurement or to strengthen policies to better engage beneficiaries. We often incorporate the feedback from lean data assessments with the beneficiaries into the deal milestones, which we evaluate rigorously and regularly.

*

This post first appeared as a LinkedIn article.