Embedding the SDGs in IMM

The Sustainable Development Goals (SDGs) have undoubtedly contributed to harmonising language, creating a common framework and thus mobilising capital to drive social change. But, is there a best strategy for embedding them within IMM practices?

For investors, the SDGs are a great communication and reporting tool, widely accepted and acknowledged by their stakeholders. In fact, 63% of investors for impact use the SDG framework as a tool for IMM, according to the EVPA Industry Survey.

But the momentum has come with a backlash.

Many investors claim to finance the SDGs, without demonstrating their specific contribution. Showcasing how an investment is aligned with the SDGs without incorporating a thorough IMM strategy poses a challenge to the credibility of the SDG framework itself. If ‘SDG-washing’ becomes widespread, SDG-exhaustion would soon follow.

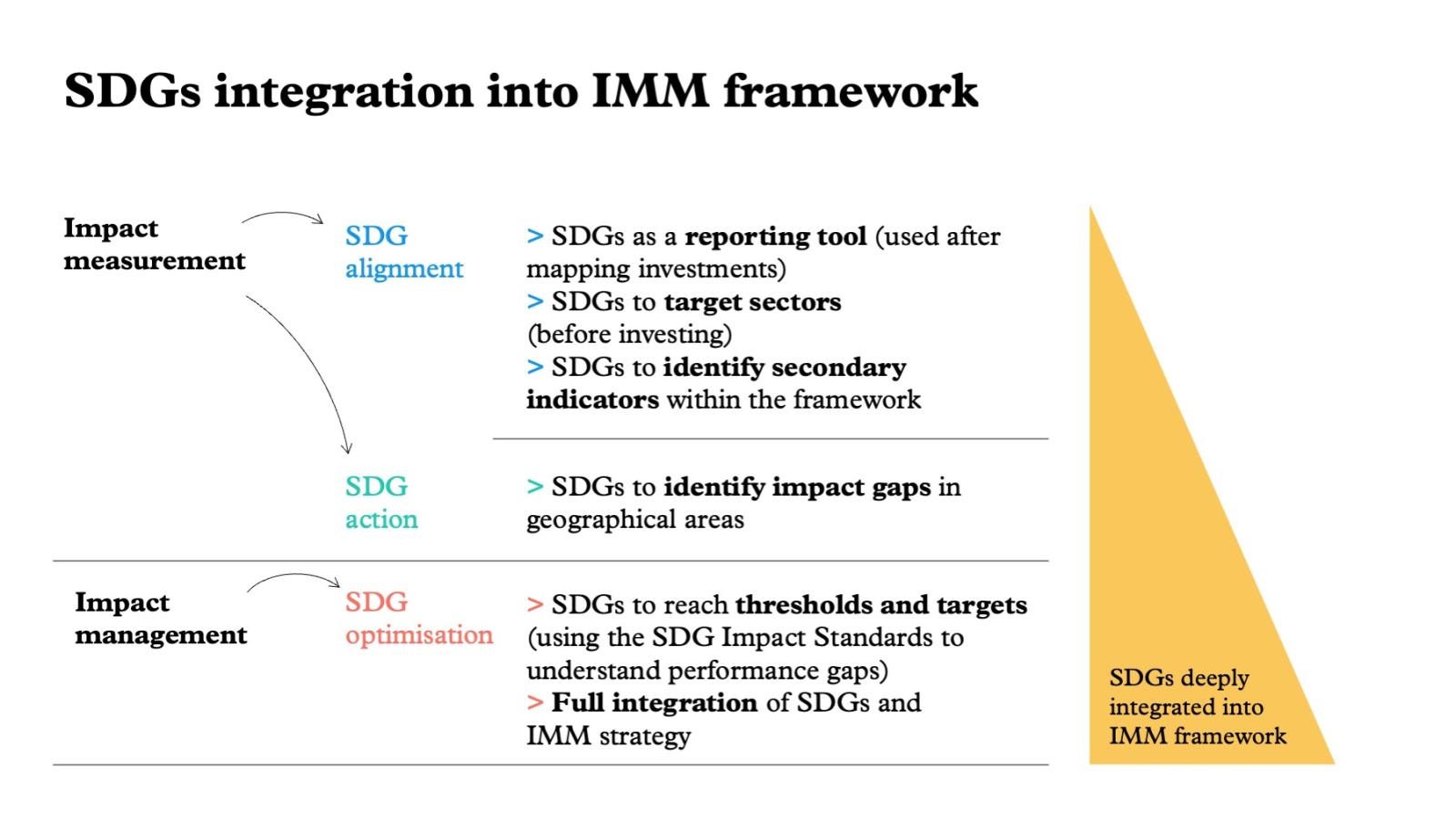

The SDGs are not an impact measurement and management framework; hence they should not replace rigorous IMM processes. However, they can be embedded in IMM practices in effective ways based on three core strategies. Investors can approach the SDGs to align, act or optimise, depending on how deeply they integrate the SDGs into their IMM framework. We have mapped the degrees of engagement with the SDGs as follows:

SDG alignment is the strategy of leveraging the marketing advantages of the SDGs to communicate what the investor is doing. This approach can have different levels of depth:

- Investors can report on SDGs after a post-investment mapping.

- Investors can use SDGs in the deal-screening phase, to target sectors and to map potential investees against targeted SDGs; this process ensures investees are aligned with the investor’s long-term objectives.

- Investors can look beyond the 17 SDGs to the subsequent indicators included in the framework. This helps investors better align their activities with the SDG framework itself. However, these indicators may be difficult to translate to social enterprises, as they are fixed at a macroeconomic level and are better suited for organisations operating in developing countries.

SDG action refers to using the SDGs to identify impact gaps in a determined geography – at either a local, regional or national level. Some initiatives are aimed at supporting investors to identify impact gaps. The SDG country-level reports assess the national SDG priorities and indicate where more action is needed. Also, the SDG Investor Platform, launched by SDG Impact and the GISD Alliance, supports investors seeking opportunities aligned with the SDGs.

SDG optimisation entails using the SDGs for managing impact, assessing not only what the investor is doing and what is needed, but also how to better capitalise the money deployed. In this case, investors can leverage the SDG Impact Standards to guarantee the integration of the SDGs into their strategy and operations. Optimisation activities include benchmarking and assessing their own impact performances; identifying points of improvement; and constantly learning to maximise positive social impacts and minimise negative ones. SDG optimisation includes also third-party impact assurance.

Whereas SDG alignment and SDG action are approaches that are an ‘add-on’ to impact measurement and management, SDG optimisation is the only strategy that fully integrates the SDGs into IMM.

These categorisations carry no judgments. Organisations can have very advanced IMM systems and only use the SDGs to align and communicate strategies – or even not use them at all. We see the categories as most useful in creating clarity around the relationship between SDGs and impact measurement and management.

We invite investors to position themselves in the different categories defined, in order to increase transparency and clarity for their strategies. Better understanding of the different roles of the SDGs within IMM practices will help coordinate action and leverage the SDG momentum.

*

Belissa Rojas -- On the three strategies to embed the SDGs in IMM (align, act, optimise)

As defined by EVPA, SDG alignment, SDG action and SDG optimisation focus on baseline (what am I doing?), gaps (what is needed?) and goals, targets and the path to get there (what will I do?), respectively. By considering a starting point, the contextual needs, a clear north and a plan to get there, the approach helps answer two key guiding questions relevant for anyone aiming to maximise net positive impacts:

- Are we doing the right (most impactful) things? This refers to ensuring resources are allocated to where they could be most impactful, considering SDG priorities and stakeholders’ preferences in the contexts where the organisations operate. It is linked to the impact we seek to achieve.

- Are we doing things right? This is related to the how; the implementation aspect is linked to effectiveness, efficiency, making decisions and acting at the pace needed.

Clarity on how investors and organisations are answering these questions, focusing both on practice and performance, can certainly contribute to reduce impact washing. The proposed three strategies help answer those questions. Using the SDG Impact Standards as the organising framework to manage sustainability impacts will help implementing the proposed three strategies and increase organisations’ likelihood of delivering positive impacts on people and planet while achieving long-term financial return.

How do the SDG Impact Standards enable integrating the SDGs into IMM?

The SDG Impact Standards are an overarching, holistic and systematic management framework designed to help private sector organisations (enterprises, PE funds, bond issuers) integrate sustainability, the SDGs and managing for impact into business and investment decision-making. They are organised around 12 actions across organisations’ strategy, management, transparency and governance practices.

The SDG Impact Standards focus on how to use impact data inside the business to generate insights and options and enable organisations to integrate those insights into business and investment decision-making. They focus on identifying the impacts that matter most and how much data is needed to make effective decisions (enough precision for the decision), including by managing risks if there are significant variances between actual and expected/needed impacts.

Rather than measuring impacts merely to report them to external stakeholders, the standards focus on the role of measuring impacts as an input to managing for impact; to first and foremost inform primary internal decision-making and help business and investment managers make more impact informed choices. This recognises that sustainability is no longer just an add-on to what business gets done but the filter through which all business gets done, in a way that is good both for the business and for people and the planet. An assurance framework is being developed to complement the standards, which will set minimum evidence requirements in line with the standards to first achieve the SDG Impact Seal.

We invite organisations to leverage the SDG Impact Standards for optimising the efficiency of their resources for impact, and for reducing the potential for negative outcomes and unintended consequences.