During this webinar, we'll take a closer look at the Charter of Investors for Impact with experienced practitioners, and unveil the new "interactive" version of theCharter!

During its 15th Annual Conference in The Hague, EVPA launched the Charter of investors for impact. With the Charter, EVPA builds on last year’s research on impact strategies to define who investors for impact are exactly and what drives them. This Charter also serves as a basis to communicate to a broader audience the DNA of investors for impact and enhance the dissemination of the tools and practices of venture philanthropy.

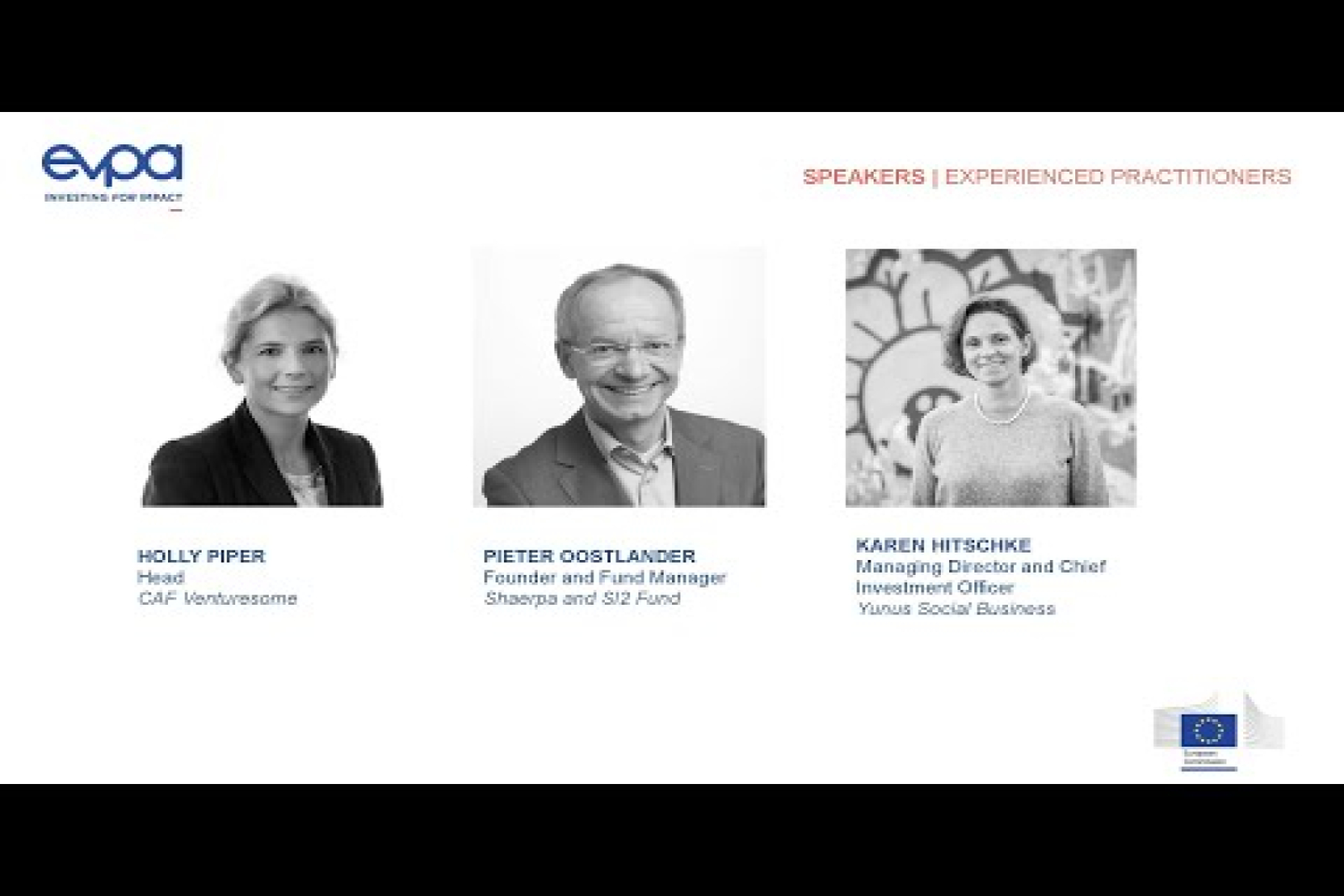

On the 29th of January, EVPA hosted a webinar to dive into the content of the Charter and understand the main features of investing for impact. During this webinar, EVPA showed a new and interactive version of the Charter, and three speakers with an extensive knowledge on investing for impact presented the principles of the Charter and how they are endorsed in practice. Participants had the opportunity to take part to the discussion and ask questions to the speakers.

Webinar Recording and Slides

Download slides here

Karen Hitschke

Karen Hitschke is Managing Director and Co-Chief Investment Officer at Yunus Social Business. She has extensive expertise and experience in fund structuring, early stage investing, and fundraising.

At YSB, Karen is responsible for overseeing the worldwide investment and portfolio management activities as well as building and training the investment team. Prior to YSB, she was the Chief Financial Officer at Affectis AG and an advisor to Swiss Business Angel Network B-to-V. Karen has also served for several years as an investment manager at Apax Partners in the life science sector and as a consultant at McKinsey & Co. She holds an MBA from INSEAD, Fontainebleau, and a M.Sc. in Biology from the University of Constance.

Pieter Oostlander

Pieter Oostlander is the founder of shærpa and was appointed Fund Manager when SI2 Fund and shærpa merged in 2015. Pieter has been active in the social investment sector since 2004.

As a director of Noaber Foundation he built its service organization, which ultimately led to the founding of shærpa. His ambition is to make social impact and value creation (in addition to creating shareholder value) the core of his professional activities. Since 10 years, Pieter serves on the Board of the European Venture Philanthropy Association (EVPA), 3 years of which as the Chair. Pieter is also a member of the board of directors of Social Value International. Prior to his career in the social investment sector, Pieter held various executive finance positions in manufacturing and IT companies.

Holly Piper

Holly is the head of CAF Venturesome, which is the social investment arm of the Charities Aid Foundation. CAF Venturesome is one of the most established and active players in the UK social investment market.

Since 2002, CAF Venturesome has made more than 640 social investments, totalling £54m, to a wide range of social organisations - from local community-led housing groups to major international development charities.

Since joining in 2012, Holly has led significant fundraising as well as managing a portfolio of innovative social investments. Holly is on the WISE 100 (top 100 women in UK social enterprise and impact investment), and is on the steering committee for the Gathering (major social investment conference). Holly previously worked at the management consultancy firm Oliver Wyman.

Alessia Gianoncelli

With a decade of experience in the social investment space, as part of her long journey at Impact Europe, the investing for impact network, Alessia contributes to build the impact investing market, by supporting impact investors and all impact stakeholders in connecting, exchanging, learning from each other, and providing them with research, data insights and capacity building opportunities. Alessia aims at accelerating impact by focusing on building partnerships with other networks and relevant actors in the field, sharing learning and good practices, breaking silos, and facilitating the creation and the exchange of knowledge.

In her capacity as Impact Europe Director of Knowledge and Programs, Alessia leads a team of 8 young enthusiastic professionals working on research activities, content and programs development, programs management, data collection, and community engagement.

Alessia co-authored publications, practical cases, and articles on topics such as venture philanthropy, impact measurement and management, impact strategies, the European impact ecosystem, tailored and hybrid finance. Thanks to her research, she prominently contributed to the Impact Europe narrative around investing for impact and to the debate on the different nuances of impact investing. Alessia is invited to speak at international conferences and give guest lectures at European Universities and Business Schools (e.g., ESADE Center for Social Impact, Nova School of Business and Economics, Luiss – Libera Università Internazionale degli Studi Sociali Guido Carli, INSEAD Business School in Paris, Solvay Brussels School Economics & Management).

Alessia also cooperates with Impact Europe's sister organisations in Latin America, Asia and Africa (GAIN, Latimpacto, AVPN and AVPA) to strengthen the collaboration among actors active in the global impact ecosystem, by sharing learning, facilitating the exchange of experiences, contributing to scale successes across regions.

Gianluca Gaggiotti

Gianluca Gaggiotti is Knowledge Manager at Impact Europe. He focuses on data analysis and content development of several research-related initiatives.

Gianluca joined Impact Europe in 2017, and since then has developed an in-depth knowledge on the impact ecosystem and all the actors involved in it. Gianluca has previously worked as a Research Assistant for several project related to development and social network economics at Bocconi University.

He holds a Master degree in Economics and Social Sciences at Bocconi University with a thesis on the effect of terrorism on political outcome in the US.